You will be redirected to the original Strategy in 15 seconds.

The BB_RTR strategy is a backtesting strategy that uses various indicators to determine buy signals. Here is a breakdown of what the strategy does:

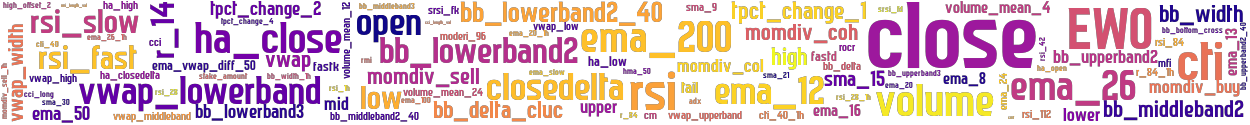

It populates several indicators, including Bollinger Bands with two standard deviations (bb_lowerband2, bb_middleband2, bb_upperband2) and Bollinger Bands with three standard deviations (bb_lowerband3, bb_middleband3, bb_upperband3). It calculates the width of the Bollinger Bands (bb_width) and the delta between the lower bands (bb_lowerband2 and bb_lowerband3) (bb_delta).

It calculates the Commodity Channel Index (CCI) for different lengths (cci_length_{val}) and the CCI for a fixed length of 26 (cci).

It calculates the Relative Momentum Index (RMI) for different lengths (rmi_length_{val}) and the RMI with a length of 4.

It calculates the Stochastic RSI (srsi_fk and srsi_fd). It calculates the difference between the current close price and the previous close price (closedelta). It calculates various moving averages: 15-day simple moving average (sma_15), 30-day simple moving average (sma_30), and 21-day simple moving average (sma_21). It calculates the Chaikin Money Flow (cmf) with a length of 20. It calculates the Money Flow Index (MFI). It calculates several exponential moving averages (ema_8, ema_12, ema_13, ema_16, ema_24, ema_26, ema_50, ema_100, ema_200). It calculates the Hull Moving Average (hma_50) with a window of 50. It calculates the VWAP Bands (vwap_upperband, vwap_middleband, vwap_lowerband) and the width of the VWAP Bands (vwap_width). It calculates the Relative Strength Index (RSI) for different lengths (rsi, rsi_fast, rsi_slow, rsi_84, rsi_112). It calculates the Elliott Wave Oscillator (EWO) with a length of 50 and 200. It calculates the Stochastic Fast (fastd, fastk). It calculates the Average Directional Index (adx). It calculates the Heikin-Ashi candles (ha_open, ha_close, ha_high, ha_low). It calculates Bollinger Bands for Heikin-Ashi candles (bb_lowerband2_40, bb_middleband2_40, bb_upperband2_40) with a window of 40 and two standard deviations. It calculates the delta between the middle and lower bands of the Bollinger Bands for Heikin-Ashi candles (bb_delta_cluc). It calculates the difference between the current Heikin-Ashi close price and the previous Heikin-Ashi close price (ha_closedelta). It calculates the difference between the Heikin-Ashi close price and the Heikin-Ashi low price (tail). It calculates the exponential moving average for the Heikin-Ashi close price with a length of 50 (ema_slow). It calculates the Rate of Change Ratio (rocr) for the Heikin-Ashi close price with a length of 28. It calculates the Williams %R (r_14) with a period of 14. It calculates the mean volume for different periods (volume_mean_4, volume_mean_12, volume_mean_24). It calculates the difference between the 50-day exponential moving average and the lower band of the VWAP Bands divided by the 50-day exponential moving average (ema_vwap_diff_50). It calculates the top percent change for different periods (tpct_change_1, tpct_change_2, tpct_change_4). It calculates the momentum divergence (momdiv_buy, momdiv_sell, momdiv_coh, momdiv_col) based on custom functions. It retrieves an informative timeframe (1h) and populates indicators for the informative timeframe, including Heikin-Ashi candles, Bollinger Bands, RSI, exponential moving averages, Williams %R, and CTI. It merges the informative timeframe data with the original timeframe data. It populates buy signals based on various conditions, including a pump condition (is_pump_1) and pump protection conditions (pump_protection_strict). Overall, the strategy uses a combination of trend indicators, oscillators, moving averages, and other technical analysis tools to generate buy signals based on specific conditions.

It calculates the Commodity Channel Index (CCI) for different lengths (cci_length_{val}) and the CCI for a fixed length of 26 (cci).

It calculates the Relative Momentum Index (RMI) for different lengths (rmi_length_{val}) and the RMI with a length of 4.

It calculates the Stochastic RSI (srsi_fk and srsi_fd). It calculates the difference between the current close price and the previous close price (closedelta). It calculates various moving averages: 15-day simple moving average (sma_15), 30-day simple moving average (sma_30), and 21-day simple moving average (sma_21). It calculates the Chaikin Money Flow (cmf) with a length of 20. It calculates the Money Flow Index (MFI). It calculates several exponential moving averages (ema_8, ema_12, ema_13, ema_16, ema_24, ema_26, ema_50, ema_100, ema_200). It calculates the Hull Moving Average (hma_50) with a window of 50. It calculates the VWAP Bands (vwap_upperband, vwap_middleband, vwap_lowerband) and the width of the VWAP Bands (vwap_width). It calculates the Relative Strength Index (RSI) for different lengths (rsi, rsi_fast, rsi_slow, rsi_84, rsi_112). It calculates the Elliott Wave Oscillator (EWO) with a length of 50 and 200. It calculates the Stochastic Fast (fastd, fastk). It calculates the Average Directional Index (adx). It calculates the Heikin-Ashi candles (ha_open, ha_close, ha_high, ha_low). It calculates Bollinger Bands for Heikin-Ashi candles (bb_lowerband2_40, bb_middleband2_40, bb_upperband2_40) with a window of 40 and two standard deviations. It calculates the delta between the middle and lower bands of the Bollinger Bands for Heikin-Ashi candles (bb_delta_cluc). It calculates the difference between the current Heikin-Ashi close price and the previous Heikin-Ashi close price (ha_closedelta). It calculates the difference between the Heikin-Ashi close price and the Heikin-Ashi low price (tail). It calculates the exponential moving average for the Heikin-Ashi close price with a length of 50 (ema_slow). It calculates the Rate of Change Ratio (rocr) for the Heikin-Ashi close price with a length of 28. It calculates the Williams %R (r_14) with a period of 14. It calculates the mean volume for different periods (volume_mean_4, volume_mean_12, volume_mean_24). It calculates the difference between the 50-day exponential moving average and the lower band of the VWAP Bands divided by the 50-day exponential moving average (ema_vwap_diff_50). It calculates the top percent change for different periods (tpct_change_1, tpct_change_2, tpct_change_4). It calculates the momentum divergence (momdiv_buy, momdiv_sell, momdiv_coh, momdiv_col) based on custom functions. It retrieves an informative timeframe (1h) and populates indicators for the informative timeframe, including Heikin-Ashi candles, Bollinger Bands, RSI, exponential moving averages, Williams %R, and CTI. It merges the informative timeframe data with the original timeframe data. It populates buy signals based on various conditions, including a pump condition (is_pump_1) and pump protection conditions (pump_protection_strict). Overall, the strategy uses a combination of trend indicators, oscillators, moving averages, and other technical analysis tools to generate buy signals based on specific conditions.

stoploss: -0.998 timeframe: 5m hash(sha256): 32e5f7ef0c01e2458e150179714da27689b491c7746f6116afd2bc06d5d55b55

Was not able to fetch indicators from Strategyfile.

last change: 2022-09-08 10:24:56