Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BBRSIOptimizedStrategy is a trading strategy that uses a combination of the RSI (Relative Strength Index) and Bollinger Bands indicators to generate buy and sell signals for trading. Here's a breakdown of what the strategy does:

The strategy uses the 15-minute timeframe for analyzing price data. It requires a minimum of 30 candles before producing valid signals.

The strategy calculates the RSI indicator and adds it to the dataframe.

It also calculates two sets of Bollinger Bands with different standard deviations (1 and 2) based on the typical price.

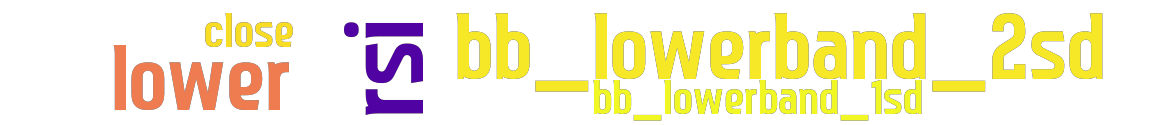

For generating buy signals, the strategy looks for conditions where the RSI is greater than 10 and the closing price is below the lower Bollinger Band with 2 standard deviations. For generating sell signals, the strategy looks for conditions where the RSI is greater than 95 and the closing price is above the lower Bollinger Band with 1 standard deviation. The strategy uses limit orders for both buying and selling, and it sets a stop loss at -0.338. The minimum return on investment (ROI) for the strategy is defined as 0.07 for the first 108 candles, 0.052 for the next 30 candles, 0.017 for the following 192 candles, and 0 for the remaining candles. The strategy does not use a trailing stop loss. The plot configuration includes the visualization of Bollinger Bands and the RSI indicator. Overall, the strategy aims to capitalize on potential buying opportunities when the price is low relative to the Bollinger Bands and the RSI indicates oversold conditions. It also looks for selling opportunities when the price is high relative to the Bollinger Bands and the RSI indicates overbought conditions.

The strategy calculates the RSI indicator and adds it to the dataframe.

It also calculates two sets of Bollinger Bands with different standard deviations (1 and 2) based on the typical price.

For generating buy signals, the strategy looks for conditions where the RSI is greater than 10 and the closing price is below the lower Bollinger Band with 2 standard deviations. For generating sell signals, the strategy looks for conditions where the RSI is greater than 95 and the closing price is above the lower Bollinger Band with 1 standard deviation. The strategy uses limit orders for both buying and selling, and it sets a stop loss at -0.338. The minimum return on investment (ROI) for the strategy is defined as 0.07 for the first 108 candles, 0.052 for the next 30 candles, 0.017 for the following 192 candles, and 0 for the remaining candles. The strategy does not use a trailing stop loss. The plot configuration includes the visualization of Bollinger Bands and the RSI indicator. Overall, the strategy aims to capitalize on potential buying opportunities when the price is low relative to the Bollinger Bands and the RSI indicates oversold conditions. It also looks for selling opportunities when the price is high relative to the Bollinger Bands and the RSI indicates overbought conditions.

stoploss: -0.338 timeframe: 15m hash(sha256): c7ed42e73edfb0efe9e52b9a6ea025fd74e7bd7addfde2b851d5043adb2c7f59 indicators: lower bb_lowerband_2sd close rsi bb_lowerband_1sd

No similar strategies found. (based on used indicators)

last change: 2023-06-27 12:34:45