Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BBL3H1Strategy is a trading strategy that uses technical analysis (TA) indicators to determine buy and sell signals. It is designed to be used in a backtesting framework. The strategy consists of the following main components:

populate_indicators: This function calculates and adds several TA indicators to the given DataFrame.

The indicators used in this strategy are Bollinger Bands with different parameters.

The upper and lower bands are calculated using a window size of 20 and standard deviations of 3 and 1 respectively.

The calculated values are then added as new columns to the DataFrame. populate_buy_trend: This function populates the buy signal for the DataFrame based on the TA indicators. In this strategy, a buy signal is generated when the closing price is below the lower Bollinger Band with a standard deviation of 3. The function updates the 'buy' column of the DataFrame accordingly. populate_sell_trend: This function populates the sell signal for the DataFrame based on the TA indicators. In this strategy, a sell signal is generated when the closing price is above the upper Bollinger Band with a standard deviation of 1. The function updates the 'sell' column of the DataFrame accordingly. Overall, the strategy aims to take advantage of potential price reversals or bounces when the price reaches the outer bands of the Bollinger Bands. The buy and sell signals are based on these price conditions.

The indicators used in this strategy are Bollinger Bands with different parameters.

The upper and lower bands are calculated using a window size of 20 and standard deviations of 3 and 1 respectively.

The calculated values are then added as new columns to the DataFrame. populate_buy_trend: This function populates the buy signal for the DataFrame based on the TA indicators. In this strategy, a buy signal is generated when the closing price is below the lower Bollinger Band with a standard deviation of 3. The function updates the 'buy' column of the DataFrame accordingly. populate_sell_trend: This function populates the sell signal for the DataFrame based on the TA indicators. In this strategy, a sell signal is generated when the closing price is above the upper Bollinger Band with a standard deviation of 1. The function updates the 'sell' column of the DataFrame accordingly. Overall, the strategy aims to take advantage of potential price reversals or bounces when the price reaches the outer bands of the Bollinger Bands. The buy and sell signals are based on these price conditions.

startup_candle_count : 20 bb_lowerband3: -0.050% bb_upperband1: 0.004%

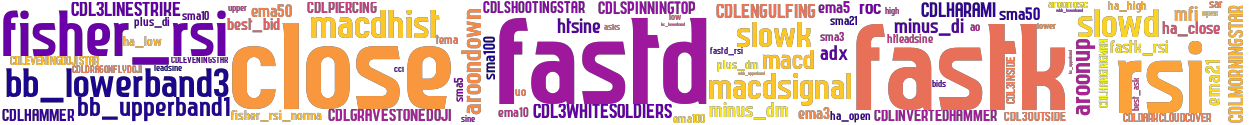

stoploss: -0.2 timeframe: 1h hash(sha256): 27ce91d0399939c28d22b927795d282bb90c710469ff62f7f7af869f19736157 indicators: bids upper bb_upperband1 lower asks close bb_lowerband3 best_ask best_bid

No similar strategies found. (based on used indicators)

last change: 2023-07-01 14:20:20