Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "adxbbrsi2" strategy is a trading strategy that combines several technical indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

It uses the ADX (Average Directional Index) indicator to identify the strength of a trend. It calculates the RSI (Relative Strength Index) to measure the momentum of price movements.

It employs Bollinger Bands, which consist of three lines (upper band, middle band, and lower band) to determine price volatility and potential reversal points.

It includes the Stochastic indicator to identify overbought and oversold conditions.

It uses the MFI (Money Flow Index) to assess the buying and selling pressure in the market. It incorporates the SAR (Stop and Reverse) indicator to identify potential price reversals. The buy signals are generated when the following conditions are met: The ADX is greater than 47, indicating a strong trend. The Stochastic Fast %D is below 41, suggesting oversold conditions. The closing price is below the lower Bollinger Band. The sell signals are generated when the following conditions are met: The ADX is greater than 67, indicating a very strong trend. The MFI is above 97, indicating overbought conditions. The Stochastic Fast %D is below 74. Additional conditions such as the RSI and SAR can be uncommented and included if desired. The strategy also includes a minimal ROI (Return on Investment) configuration, a stop-loss value, and a trailing stop feature. It operates on 1-hour timeframe data and requires at least 20 candles before producing valid signals. Please note that this is a brief overview, and the strategy's performance should be thoroughly evaluated and tested before using it in live trading.

It employs Bollinger Bands, which consist of three lines (upper band, middle band, and lower band) to determine price volatility and potential reversal points.

It includes the Stochastic indicator to identify overbought and oversold conditions.

It uses the MFI (Money Flow Index) to assess the buying and selling pressure in the market. It incorporates the SAR (Stop and Reverse) indicator to identify potential price reversals. The buy signals are generated when the following conditions are met: The ADX is greater than 47, indicating a strong trend. The Stochastic Fast %D is below 41, suggesting oversold conditions. The closing price is below the lower Bollinger Band. The sell signals are generated when the following conditions are met: The ADX is greater than 67, indicating a very strong trend. The MFI is above 97, indicating overbought conditions. The Stochastic Fast %D is below 74. Additional conditions such as the RSI and SAR can be uncommented and included if desired. The strategy also includes a minimal ROI (Return on Investment) configuration, a stop-loss value, and a trailing stop feature. It operates on 1-hour timeframe data and requires at least 20 candles before producing valid signals. Please note that this is a brief overview, and the strategy's performance should be thoroughly evaluated and tested before using it in live trading.

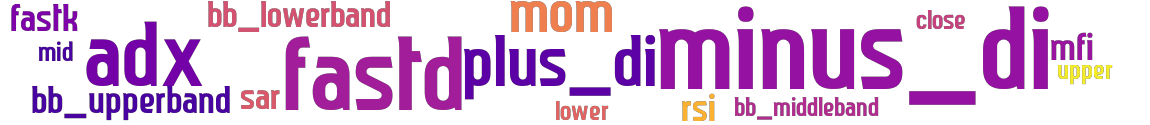

stoploss: -0.322 timeframe: 1h hash(sha256): 6b17c4265c1d16df094091675ef2d041643c1bfd9c8f973e544a233099b7d7de indicators: upper adx lower mid bb_middleband rsi close bb_upperband bb_lowerband mfi fastd fastk sar

No similar strategies found. (based on used indicators)

last change: 2023-06-27 12:37:13