Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The given code represents a trading strategy implemented in Python. Here is a description of what the strategy does:

The strategy, implemented as a class named V87XH, inherits from the IStrategy class. It has three main methods: populate_indicators, populate_buy_trend, and populate_sell_trend.

populate_indicators: The method takes a DataFrame (dataframe) and a metadata dictionary as input.

It retrieves Bitcoin (BTC) price data at different timeframes (5 minutes and 1 hour) and applies various technical indicators to them.

The indicators are merged with the original DataFrame. The method also resamples the data to another timeframe and applies additional indicators. Finally, it returns the updated DataFrame. populate_buy_trend: This method determines the conditions for buying based on the indicators and price data. It defines a list of conditions using logical operators such as greater than (>), less than (<), and rolling calculations. The conditions involve comparisons between moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), simple moving average (sma), and other parameters. If any of the conditions are met, the corresponding rows in the DataFrame are marked with a value of 1 in the 'buy' column. The updated DataFrame is returned. populate_sell_trend: This method determines the conditions for selling. It defines a list of conditions similar to the populate_buy_trend method. The conditions involve the relative strength index (rsi), Bollinger Bands (bb), and previous price data. If the conditions are met, the corresponding rows in the DataFrame are marked for selling. The updated DataFrame is returned. Overall, the strategy combines various technical indicators and price data to identify potential buying and selling opportunities in the cryptocurrency market.

populate_indicators: The method takes a DataFrame (dataframe) and a metadata dictionary as input.

It retrieves Bitcoin (BTC) price data at different timeframes (5 minutes and 1 hour) and applies various technical indicators to them.

The indicators are merged with the original DataFrame. The method also resamples the data to another timeframe and applies additional indicators. Finally, it returns the updated DataFrame. populate_buy_trend: This method determines the conditions for buying based on the indicators and price data. It defines a list of conditions using logical operators such as greater than (>), less than (<), and rolling calculations. The conditions involve comparisons between moving averages (ema), Bollinger Bands (bb), relative strength index (rsi), simple moving average (sma), and other parameters. If any of the conditions are met, the corresponding rows in the DataFrame are marked with a value of 1 in the 'buy' column. The updated DataFrame is returned. populate_sell_trend: This method determines the conditions for selling. It defines a list of conditions similar to the populate_buy_trend method. The conditions involve the relative strength index (rsi), Bollinger Bands (bb), and previous price data. If the conditions are met, the corresponding rows in the DataFrame are marked for selling. The updated DataFrame is returned. Overall, the strategy combines various technical indicators and price data to identify potential buying and selling opportunities in the cryptocurrency market.

startup_candle_count : 400 ema_100_1h: 0.001% ema_200_1h: 0.078% ewo: 0.086%

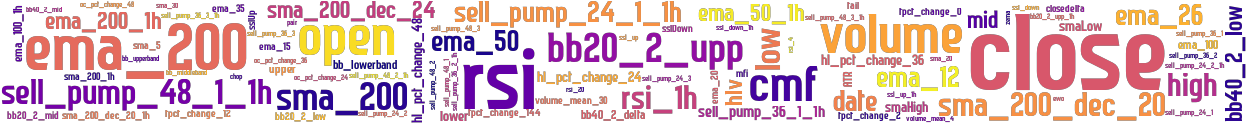

stoploss: -0.99 timeframe: 5m hash(sha256): a8a6eb5c3bf734c57ee03bb0296d130ca3384bb73267ea3c78b2b1513913889c indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 sell_pump_24_1_1h bb_lowerband ema_200_1h ewo volume smaHigh rsi_4 sma_200_dec_20 sslDown sell_pump_36_1_1h ema_20 oc_pct_change_48 sell_pump_48_1_1h high sslUp tpct_change_2 sell_pump_48_3 ssl_down_1h rsi_1h bb20_2_mid ema_12 tpct_change_12 sell_pump_48_2 ema_26 sell_pump_24_1 chop rsi_20 oc_pct_change_36 bb20_2_upp_1h closedelta hlv bb20_2_low volume_mean_4 tpct_change_0 cmf ssl_down sell_pump_48_2_1h lower rsi sell_pump_24_3

Similar Strategies: (based on used indicators)

Strategy: BigZ04NextHO, Similarity Score: 83.33%

Strategy: BigZ07Next, Similarity Score: 79.17%

Strategy: BigZ07Next2, Similarity Score: 79.17%

Strategy: BigZ0407, Similarity Score: 77.08%

Strategy: BigZ0407HO, Similarity Score: 77.08%

last change: 2023-06-28 07:12:47