The given code represents a trading strategy called "TheCluc." This strategy involves a series of calculations and conditions to determine when to buy or sell assets. Here's a brief overview of its key components:

The populate_indicators function calculates various technical indicators such as Bollinger Bands, Exponential Moving Averages (EMA), Average Directional Index (ADX), Relative Strength Index (RSI), Stochastic Oscillator, etc., based on input parameters. The populate_buy_trend function uses the calculated indicators and market data to identify potential buying opportunities based on specific conditions.

It checks for conditions related to Bollinger Bands, price changes, moving averages, volume, and other technical signals to trigger buy signals.

The strategy seems to have two main buying conditions: BinHV45: This condition checks for specific patterns involving Bollinger Bands, price changes, and tails.

If the conditions are met, a "buy" signal is generated. ClucMay72018: This condition involves checks related to EMA, Bollinger Bands, volume, and other indicators. If these conditions are satisfied, a "buy" signal is triggered. Additionally, the code includes conditions that may indicate when not to buy, based on parameters like the Chaikin's Volatility, Moving Average Convergence Divergence (MACD), and other technical factors. Please note that the given code is a partial representation, and the complete functioning of the strategy may involve other parts of the code that determine selling conditions and manage trades. The strategy's effectiveness would depend on the chosen indicators, parameters, and the overall market conditions.

It checks for conditions related to Bollinger Bands, price changes, moving averages, volume, and other technical signals to trigger buy signals.

The strategy seems to have two main buying conditions: BinHV45: This condition checks for specific patterns involving Bollinger Bands, price changes, and tails.

If the conditions are met, a "buy" signal is generated. ClucMay72018: This condition involves checks related to EMA, Bollinger Bands, volume, and other indicators. If these conditions are satisfied, a "buy" signal is triggered. Additionally, the code includes conditions that may indicate when not to buy, based on parameters like the Chaikin's Volatility, Moving Average Convergence Divergence (MACD), and other technical factors. Please note that the given code is a partial representation, and the complete functioning of the strategy may involve other parts of the code that determine selling conditions and manage trades. The strategy's effectiveness would depend on the chosen indicators, parameters, and the overall market conditions.

Traceback (most recent call last): File "/freqtrade/freqtrade/main.py", line 42, in main return_code = args['func'](args) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/commands/optimize_commands.py", line 58, in start_backtesting backtesting.start() File "/freqtrade/freqtrade/optimize/backtesting.py", line 1401, in start min_date, max_date = self.backtest_one_strategy(strat, data, timerange) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/optimize/backtesting.py", line 1318, in backtest_one_strategy preprocessed = self.strategy.advise_all_indicators(data) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, in advise_all_indicators return {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, inreturn {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1410, in advise_indicators return self.populate_indicators(dataframe, metadata) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/TheCluc.py", line 141, in populate_indicators dataframe['EWO'] = EWO(dataframe, self.fast_ewo, self.slow_ewo) ^^^^^^^^^^^^^ AttributeError: 'TheCluc' object has no attribute 'fast_ewo'

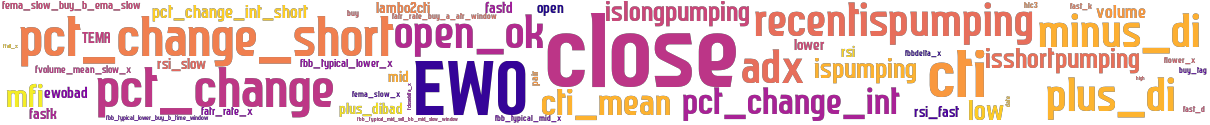

stoploss: -0.06 timeframe: 1m hash(sha256): ee6a8ec501966517c95de9b0828e82fed8cc5989c1225850e117bde1c7fb3418 indicators: bb_typical_mid_sell_bb_mid_slow_window EWO pct_change_int_short bb_typical_lower_x ispumping close cti_mean pct_change_short ema_slow_x atr_rate_x plus_dibad mfi isshortpumping pct_change ema_slow_buy_b_ema_slow fastk rsi_fast bb_typical_mid_x volume hlc3 closedelta_x bbdelta_x date open plus_di fastd open_ok pct_change_int islongpumping volume_mean_slow_x lambo2cti high fast_d mid lower_x ewobad bb_typical_lower_buy_b_time_window TEMA buy buy_tag atr_rate_buy_a_atr_window cti recentispumping ad

No similar strategies found. (based on used indicators)

last change: 2025-01-09 17:27:03