The TaSearch1mBTC strategy is a trading strategy designed for backtesting purposes. It uses technical analysis indicators to find potential buy and sell signals in cryptocurrency trading data. Here's a breakdown of the important parts of the strategy:

The strategy class TaSearch1mBTC implements the IStrategy interface, which is required by the backtesting framework.

It has two parameters: n and p.

These parameters are initialized with default values of 240 and 1, respectively.

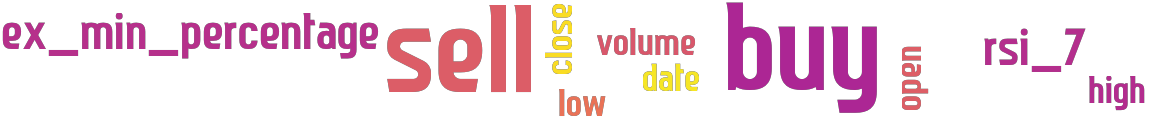

The minimal_roi dictionary defines the minimum return on investment (ROI) required for a trade to be considered successful. In this case, a minimum ROI of 0.01 (1%) is set. The stoploss variable is set to -1, indicating that no specific stop-loss rule is defined for this strategy. The strategy consists of the following methods: __init__: Initializes the strategy by creating an instance of the TaSearch class, passing the n and p parameters to it. populate_indicators: This method takes a DataFrame containing trading data and populates it with various technical indicators. It renames the columns of the DataFrame and then applies the find_extremes method from the TaSearch class to identify extreme points in the data. Next, it calls the find_buy_entry method to determine potential buy signals and adds a "sell" column based on the results of the populate_sell method. The modified DataFrame is returned. find_buy_entry: This method iterates over the DataFrame in reverse order and looks for buy entry conditions. It checks if the RSI (Relative Strength Index) value at a specific row is between 40 and 60. If this condition is met, it further checks for specific conditions related to the "ex_min_percentage" column and the time difference between buy and current rows. If all conditions are satisfied, it marks the corresponding row as a potential buy signal by setting the "buy" column to 'buy'. The modified DataFrame is returned. populate_sell: This method takes a row from the DataFrame and determines if a sell signal should be generated based on the RSI value. If the RSI value is above 80, it returns 'sell'; otherwise, it returns an empty string. populate_buy_trend and populate_sell_trend: These methods modify the DataFrame to convert the 'buy' and 'sell' columns into numeric values (1 for 'buy' and 'sell' signals, respectively), allowing for easier trend analysis. Overall, this strategy aims to identify potential buy signals when the RSI value is within a certain range and certain conditions related to extreme points and time differences are met. It generates sell signals when the RSI value exceeds a certain threshold.

It has two parameters: n and p.

These parameters are initialized with default values of 240 and 1, respectively.

The minimal_roi dictionary defines the minimum return on investment (ROI) required for a trade to be considered successful. In this case, a minimum ROI of 0.01 (1%) is set. The stoploss variable is set to -1, indicating that no specific stop-loss rule is defined for this strategy. The strategy consists of the following methods: __init__: Initializes the strategy by creating an instance of the TaSearch class, passing the n and p parameters to it. populate_indicators: This method takes a DataFrame containing trading data and populates it with various technical indicators. It renames the columns of the DataFrame and then applies the find_extremes method from the TaSearch class to identify extreme points in the data. Next, it calls the find_buy_entry method to determine potential buy signals and adds a "sell" column based on the results of the populate_sell method. The modified DataFrame is returned. find_buy_entry: This method iterates over the DataFrame in reverse order and looks for buy entry conditions. It checks if the RSI (Relative Strength Index) value at a specific row is between 40 and 60. If this condition is met, it further checks for specific conditions related to the "ex_min_percentage" column and the time difference between buy and current rows. If all conditions are satisfied, it marks the corresponding row as a potential buy signal by setting the "buy" column to 'buy'. The modified DataFrame is returned. populate_sell: This method takes a row from the DataFrame and determines if a sell signal should be generated based on the RSI value. If the RSI value is above 80, it returns 'sell'; otherwise, it returns an empty string. populate_buy_trend and populate_sell_trend: These methods modify the DataFrame to convert the 'buy' and 'sell' columns into numeric values (1 for 'buy' and 'sell' signals, respectively), allowing for easier trend analysis. Overall, this strategy aims to identify potential buy signals when the RSI value is within a certain range and certain conditions related to extreme points and time differences are met. It generates sell signals when the RSI value exceeds a certain threshold.

Unable to parse Traceback (Logfile Exceeded Limit)

stoploss: -1 timeframe: 5m hash(sha256): f78befffec788edda642b7d7d339040afb8116694f99c654010e26bdbe814f12

Was not able to fetch indicators from Strategyfile.

last change: 2025-01-15 11:10:45