Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The SafeCluc strategy is a trading strategy that utilizes various technical indicators to determine buy and sell signals. Here is a breakdown of what the strategy does:

In the populate_indicators method, the strategy calculates and adds several indicators to the dataframe, including:

Heikin-Ashi candles (open, close, high, low)

Bollinger Bands (mid, lower)

Bollinger Bands delta (bbdelta)

Close delta (closedelta)

Tail (difference between close and low)

Exponential Moving Averages (ema_fast, ema_slow)

Volume moving average (volume_mean_slow)

Rate of Change Ratio (rocr)

Relative Strength Index (RSI) and Fisher Transform (rsi, fisher)

RSI with different time periods (rsi_84, rsi_112)

Top percent changes for different time intervals (tpct_change_1, tpct_change_2, tpct_change_4, tpct_change_9)

The strategy then retrieves additional informative data for a higher timeframe (1 hour) and merges it with the current dataframe. In the populate_buy_trend method, the strategy applies various conditions to identify potential buy signals.

These conditions include: RSI values below 60 for two different time periods (rsi_84, rsi_112) Negative top percent changes for different intervals (tpct_change_1, tpct_change_2, tpct_change_4) Price pump protection conditions based on rolling maximum values Conditions involving Bollinger Bands, close delta, tail, and Heikin-Ashi candles If all the buy conditions are met, the strategy marks the corresponding row with a 'buy' signal.

In the populate_sell_trend method, the strategy identifies potential sell signals based on the following conditions: Fisher Transform values exceeding a sell threshold Decreasing highs and lows in Heikin-Ashi candles EMA crossing above the Heikin-Ashi close price Heikin-Ashi close price multiplied by a sell threshold exceeding the Bollinger Bands middle band Volume being greater than zero If all the sell conditions are met, the strategy marks the corresponding row with a 'sell' signal.

The strategy aims to generate buy and sell signals based on the combination of these technical indicators and conditions.

These conditions include: RSI values below 60 for two different time periods (rsi_84, rsi_112) Negative top percent changes for different intervals (tpct_change_1, tpct_change_2, tpct_change_4) Price pump protection conditions based on rolling maximum values Conditions involving Bollinger Bands, close delta, tail, and Heikin-Ashi candles If all the buy conditions are met, the strategy marks the corresponding row with a 'buy' signal.

In the populate_sell_trend method, the strategy identifies potential sell signals based on the following conditions: Fisher Transform values exceeding a sell threshold Decreasing highs and lows in Heikin-Ashi candles EMA crossing above the Heikin-Ashi close price Heikin-Ashi close price multiplied by a sell threshold exceeding the Bollinger Bands middle band Volume being greater than zero If all the sell conditions are met, the strategy marks the corresponding row with a 'sell' signal.

The strategy aims to generate buy and sell signals based on the combination of these technical indicators and conditions.

startup_candle_count : 168 ema_slow: 0.003% fisher: -0.008% rsi_84: -1.305% rsi_112: -1.012% mama_diff_1h: 0.002%

Unable to parse Traceback (Logfile Exceeded Limit)

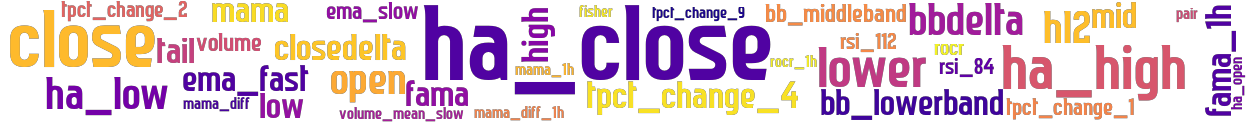

stoploss: -0.99 timeframe: 5m hash(sha256): e4b12606bdb6925437d76435f1004329069adf13fe94fd66561f90d36d9d5929 indicators: rocr_1h ha_low close tail mama_1h bb_lowerband bbdelta volume mama_diff_1h tpct_change_1 tpct_change_4 closedelta rsi_84 fama rocr open ema_fast volume_mean_slow fama_1h ha_open fisher hl2 high rsi_112 mid tpct_change_2 ha_close mama ha_high lower bb_middleband rsi ema_slow tpct_change_9 low mama_dif

Similar Strategies: (based on used indicators)

Strategy: SafeCluc_2, Similarity Score: 97.3%

last change: 2025-01-14 06:32:37