You will be redirected to the original Strategy in 15 seconds.

The "ResistanceSupport" strategy is a trading strategy that uses various technical indicators to generate buy and sell signals. Here's a breakdown of what the strategy does:

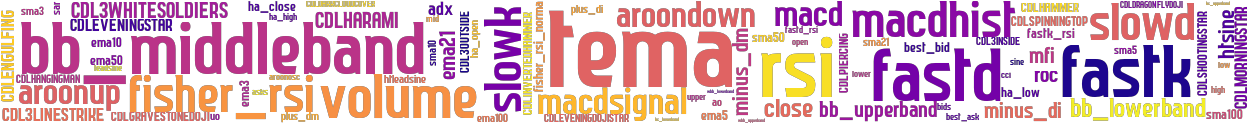

populate_indicators: This method takes a DataFrame containing exchange data and adds several technical indicators to it. The indicators used in this strategy are:

ADX (Average Directional Index)

RSI (Relative Strength Index)

Stochastic Fast (fastd and fastk)

MACD (Moving Average Convergence Divergence)

MFI (Money Flow Index)

Bollinger Bands (bb_lowerband, bb_middleband, bb_upperband, bb_percent, bb_width)

SAR (Stop and Reverse)

TEMA (Triple Exponential Moving Average)

HT Sine (htsine and htleadsine)

populate_buy_trend: This method populates the buy signal for the given DataFrame based on the indicators.

The conditions for a buy signal are: RSI crosses above 30 TEMA is below the Bollinger Bands middle line TEMA is rising Volume is greater than 0 populate_sell_trend: This method populates the sell signal for the DataFrame based on the indicators.

The conditions for a sell signal are: RSI crosses above 70 TEMA is above the Bollinger Bands middle line TEMA is falling Volume is greater than 0 The strategy uses these indicators to identify potential buying and selling opportunities in the market.

It's important to note that this is just a brief overview, and the actual implementation and effectiveness of the strategy may depend on various factors, including the specific parameters used for the indicators and the market conditions.

The conditions for a buy signal are: RSI crosses above 30 TEMA is below the Bollinger Bands middle line TEMA is rising Volume is greater than 0 populate_sell_trend: This method populates the sell signal for the DataFrame based on the indicators.

The conditions for a sell signal are: RSI crosses above 70 TEMA is above the Bollinger Bands middle line TEMA is falling Volume is greater than 0 The strategy uses these indicators to identify potential buying and selling opportunities in the market.

It's important to note that this is just a brief overview, and the actual implementation and effectiveness of the strategy may depend on various factors, including the specific parameters used for the indicators and the market conditions.

stoploss: -0.1 timeframe: 5m hash(sha256): 32f3fdf833f4a9061964cc8adfe807a5652e7a9914622e21957faa6ce9e553f4

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-11 00:51:42