Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The RSIDivergence strategy is a trading strategy that utilizes the Relative Strength Index (RSI) and other indicators to identify potential buying and selling opportunities. Here is a breakdown of how the strategy works:

Indicator Population:

The strategy populates various indicators, including RSI, Stochastic Oscillator (STOCH), SAR, and others, based on the provided price data. It also calculates the Simple Moving Average (SMA) of the RSI with a time period of 5 and a rolling window of 3.

Bullish Conditions: The strategy identifies potential bullish conditions based on specific criteria: Oscillation (osc) values reaching a new low (oscLL) while price (low) simultaneously reaches a higher low (priceHL).

Oscillation (osc) values reaching a new high (oscHH) while price (high) simultaneously reaches a lower high (priceLH).

The presence of bullish conditions (bullCond) and hidden bullish conditions (hiddenBullCond). Confirmation from the EWO (Elliott Wave Oscillator) indicator. RSI values falling below a certain threshold (high_rsi_buy). Positive volume. Bearish Conditions: The strategy identifies potential bearish conditions based on the following criteria: Oscillation (osc) values reaching a new low (oscLL) while price (low) simultaneously reaches a higher low (priceHL). Oscillation (osc) values reaching a new high (oscHH) while price (high) simultaneously reaches a lower high (priceLH). The presence of bearish conditions (bearCond) and hidden bearish conditions (hiddenBearCond). Confirmation from the EWO (Elliott Wave Oscillator) indicator. Negative volume. Stop Loss Adjustment: The strategy adjusts the stop loss (sl_new) based on the current profit. If the current profit is above 0.2, the stop loss is set to 0.05. If the current profit is between 0.1 and 0.2, the stop loss is set to 0.03. If the current profit is between 0.06 and 0.1, the stop loss is set to 0.02. If the current profit is between 0.03 and 0.06, the stop loss is set to 0.01. Overall, the RSIDivergence strategy aims to identify potential buy and sell signals based on RSI divergence and other conditions, with additional confirmation from the EWO indicator. It also dynamically adjusts the stop loss based on the current profit to manage risk.

Bullish Conditions: The strategy identifies potential bullish conditions based on specific criteria: Oscillation (osc) values reaching a new low (oscLL) while price (low) simultaneously reaches a higher low (priceHL).

Oscillation (osc) values reaching a new high (oscHH) while price (high) simultaneously reaches a lower high (priceLH).

The presence of bullish conditions (bullCond) and hidden bullish conditions (hiddenBullCond). Confirmation from the EWO (Elliott Wave Oscillator) indicator. RSI values falling below a certain threshold (high_rsi_buy). Positive volume. Bearish Conditions: The strategy identifies potential bearish conditions based on the following criteria: Oscillation (osc) values reaching a new low (oscLL) while price (low) simultaneously reaches a higher low (priceHL). Oscillation (osc) values reaching a new high (oscHH) while price (high) simultaneously reaches a lower high (priceLH). The presence of bearish conditions (bearCond) and hidden bearish conditions (hiddenBearCond). Confirmation from the EWO (Elliott Wave Oscillator) indicator. Negative volume. Stop Loss Adjustment: The strategy adjusts the stop loss (sl_new) based on the current profit. If the current profit is above 0.2, the stop loss is set to 0.05. If the current profit is between 0.1 and 0.2, the stop loss is set to 0.03. If the current profit is between 0.06 and 0.1, the stop loss is set to 0.02. If the current profit is between 0.03 and 0.06, the stop loss is set to 0.01. Overall, the RSIDivergence strategy aims to identify potential buy and sell signals based on RSI divergence and other conditions, with additional confirmation from the EWO indicator. It also dynamically adjusts the stop loss based on the current profit to manage risk.

startup_candle_count : 50 sar_4h: -0.223% RSI: 3.032% osc: 3.032% SMMA: -0.086% valuewhen_plFound_osc: 3.032% valuewhen_phFound_osc: 3.032%

Unable to parse Traceback (Logfile Exceeded Limit)

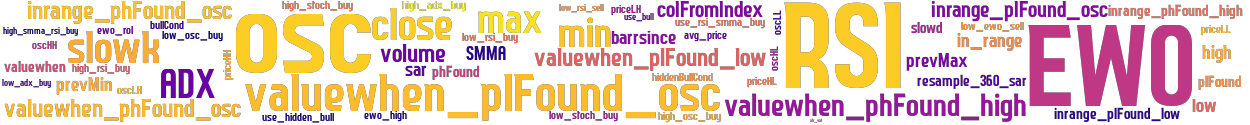

stoploss: -0.24 timeframe: 15m hash(sha256): da46cf2fd545205d621316633c35d50c7f940bbf00db26d4c0270eb0474d461c indicators: high_osc_buy hiddenBullCond EWO priceLH ewo_high oscLH oscHH close use_hidden_bull high_rsi_buy high_smma_rsi_buy priceLL use_rsi_smma_buy valuewhen_plFound_osc priceHL inrange_plFound_osc low_osc_buy low_adx_buy slowd volume low_rsi_sell valuewhen_plFound_low plFound oscLL max low_stoch_buy inrange_phFound_high sar inrange_phFound_osc high slowk SMMA valuewhen_phFound_high low_ewo_sell osc bullCond in_range oscHL valuewhen barrsince ewo_rol high_adx_buy low_rsi_buy min prevMin prevMax colFromIn

Similar Strategies: (based on used indicators)

Strategy: RSIDivergence_238, Similarity Score: 83.33%

last change: 2024-08-02 10:29:44