You will be redirected to the original Strategy in 15 seconds.

The NostalgiaForInfinityV7 strategy is a backtesting strategy for trading. It uses various indicators and conditions to determine when to execute a buy trade. In the populate_indicators function, the strategy calculates and merges informative indicators for the given timeframe.

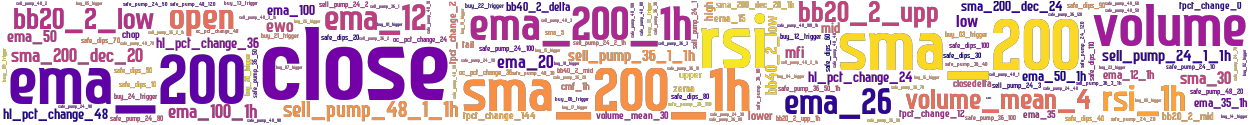

It includes indicators such as exponential moving averages (ema), simple moving averages (sma), relative strength index (rsi), and money flow index (mfi).

The populate_buy_trend function defines the conditions for executing a buy trade.

It consists of multiple protection layers (buy_01_protections, buy_02_protections, etc.) that are based on different indicators such as ema, close price above ema, sma rising, safe dips, and safe pump. These protection layers aim to filter out unfavorable market conditions. Each protection layer has its own logical conditions (buy_01_logic, buy_02_logic, etc.) that must be satisfied for the buy trigger to be activated. These conditions involve comparisons between various indicators and thresholds, such as ema values, rsi values, mfi values, and close prices relative to moving averages. If the corresponding buy condition (e.g., buy_condition_1_enable) is enabled, the buy trigger for that condition is appended to the conditions list. The buy trigger is a combination of all the logical conditions for that particular protection layer. Overall, the strategy evaluates multiple buy conditions and triggers based on different combinations of indicators and thresholds. By backtesting this strategy on historical data, it can provide insights into its performance and effectiveness.

It includes indicators such as exponential moving averages (ema), simple moving averages (sma), relative strength index (rsi), and money flow index (mfi).

The populate_buy_trend function defines the conditions for executing a buy trade.

It consists of multiple protection layers (buy_01_protections, buy_02_protections, etc.) that are based on different indicators such as ema, close price above ema, sma rising, safe dips, and safe pump. These protection layers aim to filter out unfavorable market conditions. Each protection layer has its own logical conditions (buy_01_logic, buy_02_logic, etc.) that must be satisfied for the buy trigger to be activated. These conditions involve comparisons between various indicators and thresholds, such as ema values, rsi values, mfi values, and close prices relative to moving averages. If the corresponding buy condition (e.g., buy_condition_1_enable) is enabled, the buy trigger for that condition is appended to the conditions list. The buy trigger is a combination of all the logical conditions for that particular protection layer. Overall, the strategy evaluates multiple buy conditions and triggers based on different combinations of indicators and thresholds. By backtesting this strategy on historical data, it can provide insights into its performance and effectiveness.

stoploss: -0.99 timeframe: 5m hash(sha256): acc6942785757a7a460cc5bb39adab44a9f956d7ad8c6175964f8a772b7f04d3

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-06 06:05:33