The NFIV5HYPERALL strategy is a trading strategy implemented as a class that inherits from the IStrategy class. It performs backtesting on various trading strategies. The strategy has two main methods: populate_indicators and populate_buy_trend.

The populate_indicators method takes a DataFrame and metadata as input and returns a DataFrame with populated indicators.

It merges informative indicators from the 1-hour timeframe with the main timeframe indicators.

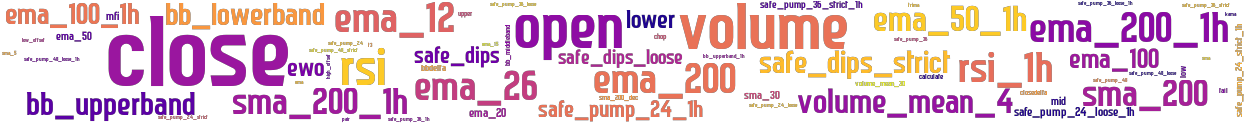

The populate_buy_trend method is responsible for determining the buy conditions for the strategy. It uses a series of conditions, represented as a list, to define the buy signals. Each condition is composed of multiple logical expressions that compare different indicators and values. These conditions check for various technical indicators and market conditions to determine when to buy. Some of the important indicators and conditions used include moving averages (EMA and SMA), relative strength index (RSI), Bollinger Bands, money flow index (MFI), and volume. The strategy appears to have multiple buy conditions, each enabled or disabled based on a specific value. Each buy condition is evaluated independently, and if any of them are true, a buy signal is generated. The conditions take into account factors like the relationship between different moving averages, price movements relative to indicators, volume thresholds, and other technical analysis factors. The strategy seems to be designed to identify potential buying opportunities based on different technical indicators and market conditions. It is a comprehensive strategy that incorporates a variety of criteria to make buy decisions.

The populate_indicators method takes a DataFrame and metadata as input and returns a DataFrame with populated indicators.

It merges informative indicators from the 1-hour timeframe with the main timeframe indicators.

The populate_buy_trend method is responsible for determining the buy conditions for the strategy. It uses a series of conditions, represented as a list, to define the buy signals. Each condition is composed of multiple logical expressions that compare different indicators and values. These conditions check for various technical indicators and market conditions to determine when to buy. Some of the important indicators and conditions used include moving averages (EMA and SMA), relative strength index (RSI), Bollinger Bands, money flow index (MFI), and volume. The strategy appears to have multiple buy conditions, each enabled or disabled based on a specific value. Each buy condition is evaluated independently, and if any of them are true, a buy signal is generated. The conditions take into account factors like the relationship between different moving averages, price movements relative to indicators, volume thresholds, and other technical analysis factors. The strategy seems to be designed to identify potential buying opportunities based on different technical indicators and market conditions. It is a comprehensive strategy that incorporates a variety of criteria to make buy decisions.

startup_candle_count : 400 ema_200_1h: 0.035% ema_200: -0.013% ewo: 1.575% t3_offset_sell: -0.001% kama_offset_sell: -0.001%

stoploss: -1 timeframe: 5m hash(sha256): d4d8ce25ff0c30943495b0a4781c8dfc1ded7c4cbcac51a2e570cf71e4a0a81d indicators: sma_200_1h upper ema_200 ema_50 safe_dips safe_pump_24_loose_1h close safe_pump_36 ema_15 tail sma_5 safe_pump_36_strict chop bb_lowerband safe_pump_24_strict mfi safe_pump_48_strict ema_200_1h sma ema trima t3 kama bbdelta ewo safe_pump_36_strict_1h safe_pump_24 volume low_offset ema_100_1h i_offset_buy closedelta ema_20 high_offset open safe_pump_36_loose safe_dips_loose safe_pump_24_1h safe_dips_strict volume_mean_30 ema_50_1h bb_upperband_1h sma_200 safe_pump_48_loose volume_mean_4 safe_pump

Similar Strategies: (based on used indicators)

Strategy: NFI5MOHO2, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_118, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_153, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_479, Similarity Score: 97.87%

Strategy: NFI5MOHO_WIP_71, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5MultiOffsetAndHO2, Similarity Score: 97.87%

Strategy: NostalgiaForInfinityV5, Similarity Score: 85.11%

Strategy: NostalgiaForInfinityV5_856, Similarity Score: 85.11%

Strategy: NFI5MOHO, Similarity Score: 80.85%

last change: 2024-05-02 22:32:01