Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The NFI46 strategy is a trading strategy that involves multiple conditions to determine when to buy assets. It uses various indicators and technical analysis tools to identify potential buying opportunities. Here is a brief description of the important parts of the strategy:

populate_indicators: This function populates the indicators used by the strategy, including informative 1-hour indicators and normal time frame indicators.

populate_buy_trend: This function defines the buying conditions for the strategy.

It consists of multiple conditions (labeled as conditions), each representing a different buying scenario.

Some of the important conditions include: Condition 1: Involves the comparison of moving averages (ema_50_1h and ema_200_1h) and various other factors like safe dips, safe pump, relative strength index (RSI), and money flow index (MFI). Condition 2: Considers the comparison of moving averages, safe pump conditions, volume, RSI, and other factors. Condition 3: Checks for the close price being higher than a certain moving average multiplied by a relative factor, along with other conditions related to safe pump, Bollinger Bands, and volume. Condition 4: Examines moving averages, safe dips, safe pump, Bollinger Bands, and volume. Condition 5: Considers moving averages, safe dips, safe pump, volume, and the relationship between exponential moving averages (EMA). Condition 6: Involves moving averages, safe dips, volume, and the relationship between exponential moving averages. Condition 7: Similar to Condition 6 but includes an additional RSI condition. Condition 8: Looks at the close price relative to a moving average, moving averages relationship, and the relationship between Smoothed Moving Averages (SMMA). Condition 9: Considers moving averages, safe dips, volume, and the relationship between simple moving average (SMA) and Bollinger Bands. These conditions represent different scenarios in which the strategy may generate a buy signal. The strategy evaluates these conditions based on the input data and returns a DataFrame indicating the buying opportunities.

populate_buy_trend: This function defines the buying conditions for the strategy.

It consists of multiple conditions (labeled as conditions), each representing a different buying scenario.

Some of the important conditions include: Condition 1: Involves the comparison of moving averages (ema_50_1h and ema_200_1h) and various other factors like safe dips, safe pump, relative strength index (RSI), and money flow index (MFI). Condition 2: Considers the comparison of moving averages, safe pump conditions, volume, RSI, and other factors. Condition 3: Checks for the close price being higher than a certain moving average multiplied by a relative factor, along with other conditions related to safe pump, Bollinger Bands, and volume. Condition 4: Examines moving averages, safe dips, safe pump, Bollinger Bands, and volume. Condition 5: Considers moving averages, safe dips, safe pump, volume, and the relationship between exponential moving averages (EMA). Condition 6: Involves moving averages, safe dips, volume, and the relationship between exponential moving averages. Condition 7: Similar to Condition 6 but includes an additional RSI condition. Condition 8: Looks at the close price relative to a moving average, moving averages relationship, and the relationship between Smoothed Moving Averages (SMMA). Condition 9: Considers moving averages, safe dips, volume, and the relationship between simple moving average (SMA) and Bollinger Bands. These conditions represent different scenarios in which the strategy may generate a buy signal. The strategy evaluates these conditions based on the input data and returns a DataFrame indicating the buying opportunities.

startup_candle_count : 400 ema_100_1h: 0.001% ema_200_1h: 0.078% ewo: 0.086%

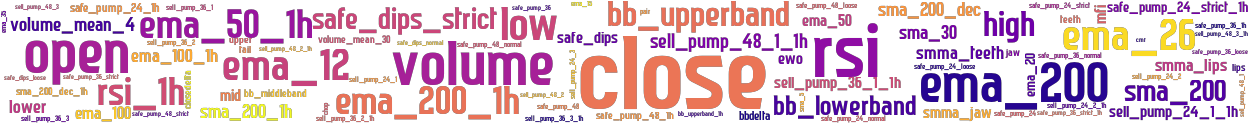

stoploss: -0.99 timeframe: 5m hash(sha256): 3db277f7e4a6ebfc00befe4dd88748be3a856b3e8fbd217f8f01a168fc7528ab indicators: sell_pump_36_3_1h sma_200_1h upper close ema_15 sell_pump_36_2 sma_5 safe_pump_36_strict sell_pump_24_1_1h bb_lowerband ema_200_1h ewo safe_pump_24 volume sell_pump_36_1_1h ema_20 safe_pump_48_1h safe_pump_24_1h sell_pump_48_1_1h bb_upperband_1h safe_pump_36_1h high safe_pump_24_normal sell_pump_48_3 rsi_1h ema_12 sell_pump_48_2 ema_26 safe_pump_24_strict_1h sell_pump_24_1 jaw safe_pump_36 smma_jaw chop safe_pump_36_strict_1h bbdelta closedelta safe_dips_loose safe_dips_normal safe_pump_48_loose

Similar Strategies: (based on used indicators)

Strategy: NFI46_217, Similarity Score: 97.56%

Strategy: NFI46Z, Similarity Score: 95.12%

Strategy: NFI46Z_212, Similarity Score: 95.12%

Strategy: NFI47, Similarity Score: 90.24%

Strategy: NFI47V2, Similarity Score: 90.24%

Strategy: NFI46Offset, Similarity Score: 87.8%

Strategy: NFI46OffsetHOA1, Similarity Score: 87.8%

Strategy: NFI46OffsetHOA1_222, Similarity Score: 87.8%

Strategy: Combined_NFIv6_SMA, Similarity Score: 80.49%

Strategy: Combined_NFIv6_SMA_863, Similarity Score: 80.49%

Strategy: NostalgiaForInfinityNext_76, Similarity Score: 80.49%

last change: 2023-08-02 13:21:29