You will be redirected to the original Strategy in 15 seconds.

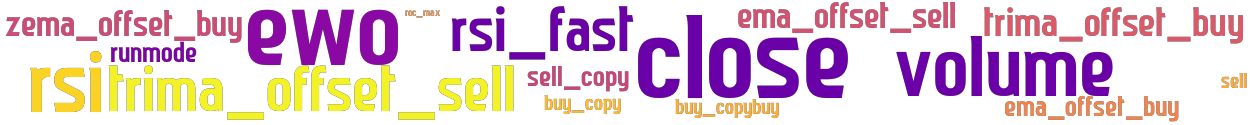

The MultiMA_TSL strategy is a trading strategy that utilizes multiple moving averages and various technical indicators to generate buy and sell signals. Here is a breakdown of how the strategy works:

Indicator Calculation:

Calculates the EWO (Elder's Force Index) using the provided fast_ewo and slow_ewo parameters. Calculates the RSI (Relative Strength Index) with a time period of 14.

Calculates a faster RSI with a time period of 4.

Calculates the maximum rate of change (ROC) of the closing price over the last 48 periods, rolling window of 12 periods.

Buy Signal Generation: Calculates offsets for different moving averages (EMA, ZEMA, TRIMA) based on specified parameters. Initializes buy_tag, buy_copy, and buy columns in the dataframe. Generates buy signals based on certain conditions for each moving average type: For TRIMA: If the close price is below the trima_offset_buy and meets specific EWO and RSI conditions. For ZEMA: If the close price is below the zema_offset_buy and meets specific EWO and RSI conditions. Adds the corresponding buy_tag to the buy_tag column and appends the buy_offset conditions to the list of conditions. Sets the buy_copy and buy columns to 1 for rows that meet additional check conditions. Sell Signal Generation: Initializes sell_copy column in the dataframe. Calculates offsets for moving averages (EMA and TRIMA) based on specified parameters. Creates conditions for sell signals: If the close price is above the ema_offset_sell and the volume is greater than 0. If the close price is above the trima_offset_sell and the volume is greater than 0. Sets the sell_copy and sell columns to 1 for rows that meet any of the sell conditions. If the strategy is not running in backtest or hyperopt mode, sets the sell column to 0 for all rows. Additional Calculation: Copies the input dataframe for further calculations. Calculates the difference between two exponential moving averages (sma1 and sma2) divided by the closing price, multiplied by 100. This is stored in the smadif variable. Returns the smadif value. This strategy combines multiple moving averages, EWO, RSI, and rate of change indicators to generate buy and sell signals based on specific conditions.

Calculates a faster RSI with a time period of 4.

Calculates the maximum rate of change (ROC) of the closing price over the last 48 periods, rolling window of 12 periods.

Buy Signal Generation: Calculates offsets for different moving averages (EMA, ZEMA, TRIMA) based on specified parameters. Initializes buy_tag, buy_copy, and buy columns in the dataframe. Generates buy signals based on certain conditions for each moving average type: For TRIMA: If the close price is below the trima_offset_buy and meets specific EWO and RSI conditions. For ZEMA: If the close price is below the zema_offset_buy and meets specific EWO and RSI conditions. Adds the corresponding buy_tag to the buy_tag column and appends the buy_offset conditions to the list of conditions. Sets the buy_copy and buy columns to 1 for rows that meet additional check conditions. Sell Signal Generation: Initializes sell_copy column in the dataframe. Calculates offsets for moving averages (EMA and TRIMA) based on specified parameters. Creates conditions for sell signals: If the close price is above the ema_offset_sell and the volume is greater than 0. If the close price is above the trima_offset_sell and the volume is greater than 0. Sets the sell_copy and sell columns to 1 for rows that meet any of the sell conditions. If the strategy is not running in backtest or hyperopt mode, sets the sell column to 0 for all rows. Additional Calculation: Copies the input dataframe for further calculations. Calculates the difference between two exponential moving averages (sma1 and sma2) divided by the closing price, multiplied by 100. This is stored in the smadif variable. Returns the smadif value. This strategy combines multiple moving averages, EWO, RSI, and rate of change indicators to generate buy and sell signals based on specific conditions.

stoploss: -0.15 timeframe: 5m hash(sha256): 67f2b59fff84e711fa10aa4f97255cdfa2d320b0d1cd811dd4b9884843c0681e

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08