You will be redirected to the original Strategy in 15 seconds.

The MultiMA_TSL3 strategy is a backtesting strategy that combines multiple technical indicators to determine buying conditions in a trading system. Here is a breakdown of its main components:

Indicator Population:

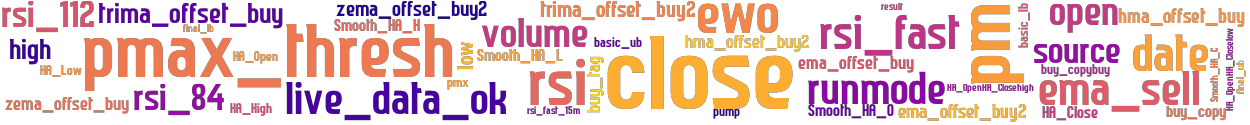

Calculates the EWO (Elliott Wave Oscillator), RSI (Relative Strength Index), and other indicators using the given data. Generates additional indicators like Heikin-Ashi candles, pmax threshold, and customized information for each trading pair.

Buy Trend Population: Sets up various conditions for buying based on different indicator combinations.

Calculates offsets for EMA (Exponential Moving Average), TRIMA (Triangular Moving Average), and HMA (Hull Moving Average) indicators.

Checks for buy signals using conditions such as close price crossing the offset lines, RSI values, and other criteria. Appends buy tags to indicate which conditions triggered the buy signal. Sell Trend Population: Currently, the strategy does not implement any specific sell conditions. The "sell" column remains unchanged. The MultiMA_TSL3a strategy is an extension of MultiMA_TSL3 with additional features: Incorporates indicators and data from a higher timeframe (15 minutes) by merging informative pair data. Drops unnecessary columns from the merged data. Includes a "pump" indicator to detect significant price increases (pumps). Please note that the provided description is based solely on the code snippet provided, and further details about the strategy's logic and functionality may be required for a comprehensive understanding.

Buy Trend Population: Sets up various conditions for buying based on different indicator combinations.

Calculates offsets for EMA (Exponential Moving Average), TRIMA (Triangular Moving Average), and HMA (Hull Moving Average) indicators.

Checks for buy signals using conditions such as close price crossing the offset lines, RSI values, and other criteria. Appends buy tags to indicate which conditions triggered the buy signal. Sell Trend Population: Currently, the strategy does not implement any specific sell conditions. The "sell" column remains unchanged. The MultiMA_TSL3a strategy is an extension of MultiMA_TSL3 with additional features: Incorporates indicators and data from a higher timeframe (15 minutes) by merging informative pair data. Drops unnecessary columns from the merged data. Includes a "pump" indicator to detect significant price increases (pumps). Please note that the provided description is based solely on the code snippet provided, and further details about the strategy's logic and functionality may be required for a comprehensive understanding.

stoploss: -0.15 timeframe: 5m hash(sha256): 82d81487ec3408f3c6ec135d9b5f3bfce8a33744df94d1c29059b8027b2dff52

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-11 15:27:54