The MoniGoManiHyperStrategy is a trading strategy implemented as a class that inherits from the IStrategy base class. It is designed for backtesting purposes and involves the following key steps:

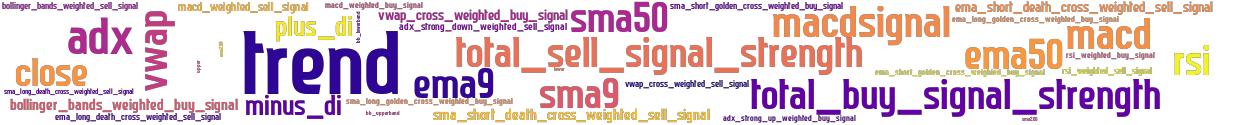

populate_indicators: This method calculates various technical indicators and adds them to the input DataFrame. The indicators used in this strategy include:

Average Directional Index (ADX)

Plus Directional Indicator (+DI)

Minus Directional Indicator (-DI)

Relative Strength Index (RSI)

Moving Average Convergence Divergence (MACD)

Simple Moving Averages (SMA) with different time periods

Exponential Moving Averages (EMA) with different time periods

Bollinger Bands

Volume Weighted Average Price (VWAP)

populate_buy_trend: This method populates the "buy" signal based on the calculated indicators and the current market conditions.

The buy signal is determined based on certain conditions for each indicator and the overall trend.

The signal strength is calculated by assigning weights to different indicators and summing up their respective signals.

The strategy uses a combination of indicators to identify potential buying opportunities in the market. It takes into account the trend direction indicated by the ADX and the relative strengths of the indicators such as RSI, MACD, and various moving averages. The buy signal strength is determined by the weighted combination of these indicators. Please note that the code provided is incomplete, and there might be additional methods or code sections in the actual implementation.

The buy signal is determined based on certain conditions for each indicator and the overall trend.

The signal strength is calculated by assigning weights to different indicators and summing up their respective signals.

The strategy uses a combination of indicators to identify potential buying opportunities in the market. It takes into account the trend direction indicated by the ADX and the relative strengths of the indicators such as RSI, MACD, and various moving averages. The buy signal strength is determined by the weighted combination of these indicators. Please note that the code provided is incomplete, and there might be additional methods or code sections in the actual implementation.

Traceback (most recent call last): File "/freqtrade/freqtrade/main.py", line 42, in main return_code = args['func'](args) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/commands/optimize_commands.py", line 58, in start_backtesting backtesting.start() File "/freqtrade/freqtrade/optimize/backtesting.py", line 1401, in start min_date, max_date = self.backtest_one_strategy(strat, data, timerange) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/optimize/backtesting.py", line 1318, in backtest_one_strategy preprocessed = self.strategy.advise_all_indicators(data) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, in advise_all_indicators return {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1378, inreturn {pair: self.advise_indicators(pair_data.copy(), {'pair': pair}).copy() ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/strategy/interface.py", line 1410, in advise_indicators return self.populate_indicators(dataframe, metadata) ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/MoniGoManiHyperStrategy.py", line 443, in populate_indicators dataframe['vwap'] = qtpylib.vwap(dataframe) ^^^^^^^^^^^^^^^^^^^^^^^ File "/freqtrade/freqtrade/vendor/qtpylib/indicators.py", line 333, in vwap raise ValueError("using `qtpylib.vwap` facilitates lookahead bias. Please use " ValueError: using `qtpylib.vwap` facilitates lookahead bias. Please use `qtpylib.rolling_vwap` instead, which calculates vwap in a rolling manner.

stoploss: -0.347 timeframe: 1h hash(sha256): a606b0627df77cf7c418d4b98f58f6b3ad2cb62967bc5e7ddda8a0a2d2fe0b45 indicators: adx_strong_up_weighted_buy_signal upper bollinger_bands_weighted_buy_signal total_buy_signal_strength close sma_long_death_cross_weighted_sell_signal bb_lowerband ema_long_death_cross_weighted_sell_signal rsi_weighted_sell_signal trend sma_short_death_cross_weighted_sell_signal sma9 plus_di ema_long_golden_cross_weighted_buy_signal ema9 vwap_cross_weighted_buy_signal macdsignal macd_weighted_sell_signal sma50 ema_short_death_cross_weighted_sell_signal ema_short_golden_cross_weighted_buy_signal m

No similar strategies found. (based on used indicators)

last change: 2024-04-29 21:29:14