The MLStrategy class is a trading strategy that utilizes machine learning techniques for decision-making. Here is a breakdown of what the strategy does:

populate_indicators(): This method calculates various indicators such as Simple Moving Averages (SMA), Relative Strength Index (RSI), and Bollinger Bands (BBANDS) using the input dataframe. The calculated indicators are added as columns to the dataframe.

Preparing Data for Prediction: The columns 'open', 'high', 'low', 'close', and 'volume' are stacked in a single row format for further processing.

Shifting the values of each column by a specified window length and stacking them in separate columns.

Reordering the columns to move indicator columns (SMA, RSI, BBANDS) to the end. Dropping unnecessary columns and removing rows with missing values. Predicting Buy and Sell Signals: The strategy predicts buy signals by utilizing machine learning models trained on different timeframes. The predictions are stored in the 'buy' column of the dataframe. The strategy predicts sell signals by considering the 'sell' parameter and using the same machine learning models. The predictions are stored in the 'sell' column of the dataframe. Majority Voting: The strategy combines the predictions from different timeframes and performs a majority voting to determine the final trading decision for each timestep. If over half of the models predicted 'True', it generates a 'True' prediction; otherwise, it generates 'False'. populate_buy_trend(): This method populates the 'buy' column of the dataframe with the predictions obtained from the machine learning models for the corresponding trading pair. populate_sell_trend(): This method populates the 'sell' column of the dataframe with the predictions obtained from the machine learning models for the corresponding trading pair. proposed_stake(): This method calculates the proposed stake amount for a trade based on the current market conditions and configuration parameters. If the fastk_rsi_1h indicator is greater than the fastd_rsi_1h indicator, it suggests a maximum stake. Otherwise, it calculates the stake amount based on the wallet balance and maximum open trades. Please note that there is a commented section at the end of the code that seems unrelated to the strategy description.

Preparing Data for Prediction: The columns 'open', 'high', 'low', 'close', and 'volume' are stacked in a single row format for further processing.

Shifting the values of each column by a specified window length and stacking them in separate columns.

Reordering the columns to move indicator columns (SMA, RSI, BBANDS) to the end. Dropping unnecessary columns and removing rows with missing values. Predicting Buy and Sell Signals: The strategy predicts buy signals by utilizing machine learning models trained on different timeframes. The predictions are stored in the 'buy' column of the dataframe. The strategy predicts sell signals by considering the 'sell' parameter and using the same machine learning models. The predictions are stored in the 'sell' column of the dataframe. Majority Voting: The strategy combines the predictions from different timeframes and performs a majority voting to determine the final trading decision for each timestep. If over half of the models predicted 'True', it generates a 'True' prediction; otherwise, it generates 'False'. populate_buy_trend(): This method populates the 'buy' column of the dataframe with the predictions obtained from the machine learning models for the corresponding trading pair. populate_sell_trend(): This method populates the 'sell' column of the dataframe with the predictions obtained from the machine learning models for the corresponding trading pair. proposed_stake(): This method calculates the proposed stake amount for a trade based on the current market conditions and configuration parameters. If the fastk_rsi_1h indicator is greater than the fastd_rsi_1h indicator, it suggests a maximum stake. Otherwise, it calculates the stake amount based on the wallet balance and maximum open trades. Please note that there is a commented section at the end of the code that seems unrelated to the strategy description.

Traceback (most recent call last): File "/freqtrade/freqtrade/strategy/strategy_wrapper.py", line 27, in wrapper return f(*args, **kwargs) ^^^^^^^^^^^^^^^^^^ File "/freqtrade/user_data/strategies/MLStrategy.py", line 29, in bot_start with open(f'model_{self.model_kind}_{pair.replace("/", "-")}_{timeframe}.pkl', 'rb') as file: ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ FileNotFoundError: [Errno 2] No such file or directory: 'model_DecisionTree_DOGE-USDT_5m.pkl'

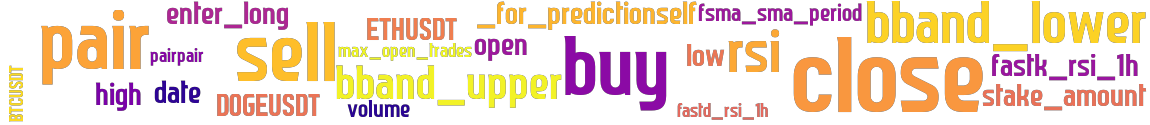

stoploss: -0.271 timeframe: 5m hash(sha256): 5b2ce1d2ec9a1a60108b25b3c18c0a4423f8d6fcc1ee9753e262ef43c01ae06b indicators: fastk_rsi_1h rsi bband_lower bband_upper open high low close volume enter_long sell fastd_rsi_1h stake_amount _for_predictionself close rsi bband_lower sma_sma_period max_open_trades date buy bband_upper

Similar Strategies: (based on used indicators)

Strategy: MLStrategy2, Similarity Score: 95.65%

last change: 2025-01-10 13:47:41