Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The "Ichimoku_v1" strategy is a trading strategy that utilizes the Ichimoku Cloud indicator to generate buy and sell signals. Here's a breakdown of how the strategy works:

The strategy defines a "minimal_roi" (Return on Investment) parameter that sets the desired profit targets for the trades. In this case, it aims for a 10% ROI for short-term trades and 7.5% ROI for longer-term trades.

The ticker_interval is set to '4h', indicating that the strategy operates on 4-hour candlestick data.

The strategy implements a trailing stop-loss mechanism.

The stoploss parameter is set to -1, indicating that no fixed stop-loss level is used. Instead, a trailing stop is applied to protect profits. The trailing stop will start trailing once the trailing_stop_positive_offset of 0.50 is reached, and it will trail by a positive percentage of the price (trailing_stop_positive) of 0.35. The "informative_pairs" method returns an empty list, indicating that there are no additional informative pairs required for this strategy. The "populate_indicators" method calculates the Ichimoku Cloud indicators for the given candlestick data. The conversion line, base line, leading span A, leading span B, and cloud colors (green and red) are calculated and stored in the dataframe. The "populate_buy_trend" method determines the buy signals based on specific conditions: When the leading span A crosses above the leading span B (senkou_a > senkou_b). The closing price is above both the leading span A and leading span B. The cloud color is green (cloud_green == True). The "populate_sell_trend" method determines the sell signals based on specific conditions: When the leading span B crosses above the leading span A (senkou_b > senkou_a). The closing price is below both the leading span A and leading span B. The cloud color is red (cloud_red == True). Overall, the strategy aims to generate buy signals when the price is above the Ichimoku Cloud and the cloud color is green, and sell signals when the price is below the Ichimoku Cloud and the cloud color is red. The trailing stop-loss mechanism is used to protect profits as the price moves in favor of the trades.

The ticker_interval is set to '4h', indicating that the strategy operates on 4-hour candlestick data.

The strategy implements a trailing stop-loss mechanism.

The stoploss parameter is set to -1, indicating that no fixed stop-loss level is used. Instead, a trailing stop is applied to protect profits. The trailing stop will start trailing once the trailing_stop_positive_offset of 0.50 is reached, and it will trail by a positive percentage of the price (trailing_stop_positive) of 0.35. The "informative_pairs" method returns an empty list, indicating that there are no additional informative pairs required for this strategy. The "populate_indicators" method calculates the Ichimoku Cloud indicators for the given candlestick data. The conversion line, base line, leading span A, leading span B, and cloud colors (green and red) are calculated and stored in the dataframe. The "populate_buy_trend" method determines the buy signals based on specific conditions: When the leading span A crosses above the leading span B (senkou_a > senkou_b). The closing price is above both the leading span A and leading span B. The cloud color is green (cloud_green == True). The "populate_sell_trend" method determines the sell signals based on specific conditions: When the leading span B crosses above the leading span A (senkou_b > senkou_a). The closing price is below both the leading span A and leading span B. The cloud color is red (cloud_red == True). Overall, the strategy aims to generate buy signals when the price is above the Ichimoku Cloud and the cloud color is green, and sell signals when the price is below the Ichimoku Cloud and the cloud color is red. The trailing stop-loss mechanism is used to protect profits as the price moves in favor of the trades.

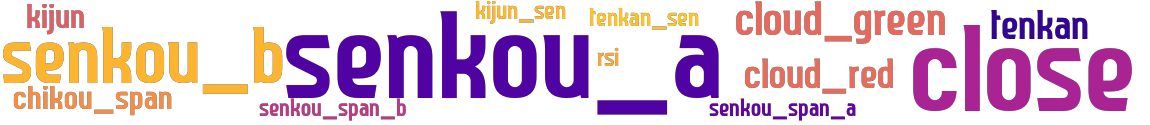

stoploss: -1 timeframe: 4h hash(sha256): 5a30561d20a70d0ada00167551608d92eebfbf808a84bf654205b3233a70bcff indicators: kijun_sen tenkan senkou_span_a close cloud_green senkou_a senkou_b kijun tenkan_sen cloud_red senkou_span_b

No similar strategies found. (based on used indicators)

last change: 2024-05-02 13:35:59