The GodStra strategy is a backtesting strategy implemented as a class in Python. It inherits from the IStrategy class, which suggests that it is designed to be compatible with a specific backtesting framework or platform. The strategy consists of three main methods: populate_indicators, populate_buy_trend, and populate_sell_trend.

populate_indicators: This method takes a DataFrame as input, representing historical trading data, and a metadata dictionary.

It preprocesses the DataFrame by removing any rows with missing values and then adds technical analysis indicators to the DataFrame using the add_all_ta_features function.

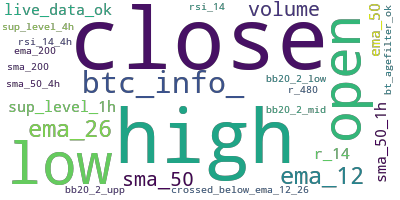

The indicators are computed based on the columns of the DataFrame representing the open, high, low, close, and volume data of the trading instrument. The modified DataFrame is returned. populate_buy_trend: This method populates the "buy" column of the DataFrame based on a set of buy conditions specified in the strategy's parameters. The method iterates over the buy parameters, which are likely defined outside this class. For each parameter, it retrieves the necessary information such as the operator (OPR), the indicator (IND), the crossover indicator (CRS), and threshold values (INT, REAL). Based on the operator, it compares the indicator and crossover indicator values and appends the resulting condition to a list of conditions. Finally, it applies the logical AND operation to all conditions using reduce(lambda x, y: x & y, conditions) and sets the corresponding "buy" column values to 1 where the conditions are satisfied. populate_sell_trend: This method is similar to populate_buy_trend but populates the "sell" column of the DataFrame based on the sell conditions specified in the strategy's parameters. It follows a similar process of iterating over the sell parameters, comparing indicator and crossover indicator values, and applying logical conditions to populate the "sell" column accordingly. Overall, the strategy takes historical trading data, computes technical indicators, and generates "buy" and "sell" signals based on user-defined conditions. It is designed to be used within a backtesting framework or platform to evaluate the performance of the strategy on historical data.

populate_indicators: This method takes a DataFrame as input, representing historical trading data, and a metadata dictionary.

It preprocesses the DataFrame by removing any rows with missing values and then adds technical analysis indicators to the DataFrame using the add_all_ta_features function.

The indicators are computed based on the columns of the DataFrame representing the open, high, low, close, and volume data of the trading instrument. The modified DataFrame is returned. populate_buy_trend: This method populates the "buy" column of the DataFrame based on a set of buy conditions specified in the strategy's parameters. The method iterates over the buy parameters, which are likely defined outside this class. For each parameter, it retrieves the necessary information such as the operator (OPR), the indicator (IND), the crossover indicator (CRS), and threshold values (INT, REAL). Based on the operator, it compares the indicator and crossover indicator values and appends the resulting condition to a list of conditions. Finally, it applies the logical AND operation to all conditions using reduce(lambda x, y: x & y, conditions) and sets the corresponding "buy" column values to 1 where the conditions are satisfied. populate_sell_trend: This method is similar to populate_buy_trend but populates the "sell" column of the DataFrame based on the sell conditions specified in the strategy's parameters. It follows a similar process of iterating over the sell parameters, comparing indicator and crossover indicator values, and applying logical conditions to populate the "sell" column accordingly. Overall, the strategy takes historical trading data, computes technical indicators, and generates "buy" and "sell" signals based on user-defined conditions. It is designed to be used within a backtesting framework or platform to evaluate the performance of the strategy on historical data.

stoploss: -0.345 timeframe: 12h hash(sha256): 1ac32a523ed4d69935db5bab2800565a636c5fe9c41e85edcdc9f7e959db4808

Was not able to fetch indicators from Strategyfile.

last change: 2024-04-28 16:10:31