The "FreqGym_normalized" strategy is a trading strategy that involves the use of various technical analysis (TA) indicators to make buy and sell decisions. The strategy aims to populate a DataFrame with these indicators and use them to generate signals for buying and selling. The strategy first populates the DataFrame with multiple TA indicators, such as PLUS_DI, MINUS_DI, HT_SINE, BOP, STOCH, STOCHF, Bollinger Bands, ADX, AROON, CMO, DX, MFI, WILLR, RSI, Fisher RSI, STOCHRSI, and LINEARREG_ANGLE.

Each indicator is normalized within a specific range to ensure consistent scaling across different indicators.

After populating the indicators, the strategy moves on to populate the buy and sell signals.

It uses an RL (reinforcement learning) model to predict the action to take based on the indicators. The predicted action is then used to determine the buy and sell signals. The buy signal is set to 1 when the predicted action is 1 (indicating a buy), and the sell signal is set to 1 when the predicted action is 2 (indicating a sell). Finally, the strategy generates an output DataFrame with the predicted results for each time window. The strategy uses a sliding window approach, where it takes a subset of indicators for each window and predicts the outcome using the RL model. The predicted results are stored in the output DataFrame. Overall, this strategy combines multiple TA indicators and an RL model to generate buy and sell signals for trading. It aims to backtest and evaluate the performance of these signals using historical data.

Each indicator is normalized within a specific range to ensure consistent scaling across different indicators.

After populating the indicators, the strategy moves on to populate the buy and sell signals.

It uses an RL (reinforcement learning) model to predict the action to take based on the indicators. The predicted action is then used to determine the buy and sell signals. The buy signal is set to 1 when the predicted action is 1 (indicating a buy), and the sell signal is set to 1 when the predicted action is 2 (indicating a sell). Finally, the strategy generates an output DataFrame with the predicted results for each time window. The strategy uses a sliding window approach, where it takes a subset of indicators for each window and predicts the outcome using the RL model. The predicted results are stored in the output DataFrame. Overall, this strategy combines multiple TA indicators and an RL model to generate buy and sell signals for trading. It aims to backtest and evaluate the performance of these signals using historical data.

Unable to parse Traceback (Logfile Exceeded Limit)

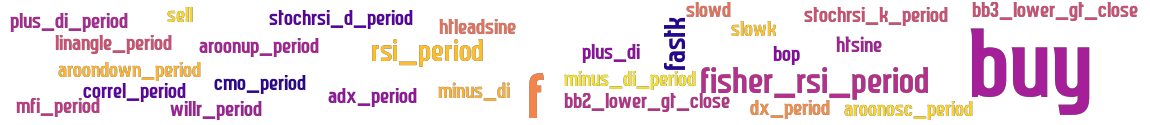

stoploss: -0.99 timeframe: 5m hash(sha256): 5468bfad745ef19fdfeef81b2e97c670c675577c6d1d3048dbd5a159f3d9a2df indicators: sell htsine f"aroondown_period f"aroonosc_period f"dx_period fastk htleadsine f"linangle_period slowd f"rsi_period bb3_lower_gt_close plus_di f"mfi_period f"plus_di_period slowk bb2_lower_gt_close f"adx_period f"willr_period buy f"stochrsi_k_period f"aroonup_period f"stochrsi_d_period minus_di f"cmo_period f"minus_di_period bop f"fisher_rsi_period

Similar Strategies: (based on used indicators)

Strategy: FreqGym_normalized_0, Similarity Score: 96.43%

Strategy: FreqGym_normalized_3, Similarity Score: 96.43%

last change: 2025-01-13 21:28:59