You will be redirected to the original Strategy in 15 seconds.

The ElliotV5 strategy is a trading strategy that uses various technical indicators to generate buy and sell signals. Here is a short description of what the strategy does:

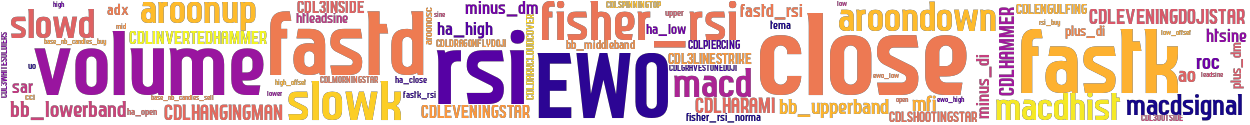

The strategy first populates the indicators by calculating values such as Average Directional Index (ADX), Plus Directional Movement (+DM), Minus Directional Movement (-DM), Aroon Up and Down, Awesome Oscillator (AO), Keltner Channels, Ultimate Oscillator (UO), Commodity Channel Index (CCI), Relative Strength Index (RSI), Fisher Transform of RSI, Stochastic Oscillator (SlowD and SlowK), Fast Stochastic Oscillator (FastD and FastK), Stochastic RSI (FastD_RSI and FastK_RSI), Moving Average Convergence Divergence (MACD), Money Flow Index (MFI), Rate of Change (ROC), Bollinger Bands, Parabolic SAR (SAR), Triple Exponential Moving Average (TEMA), Hilbert Transform - SineWave (HTSine and HTLeadSine), and various candlestick pattern indicators. The strategy then calculates moving averages for different time periods (base_nb_candles_buy and base_nb_candles_sell) and stores them in the dataframe.

The EWO (Elliott Wave Oscillator) indicator is calculated based on the fast_ewo and slow_ewo parameters.

The RSI (Relative Strength Index) is calculated with a time period of 14.

In the populate_buy_trend method, buy signals are generated based on certain conditions. These conditions include the close price being below the moving average multiplied by a low offset, the EWO being above a certain threshold (ewo_high), the RSI being below a certain threshold (rsi_buy), and the volume being greater than zero. In the populate_sell_trend method, sell signals are generated based on the condition that the close price is above the moving average multiplied by a high offset, and the volume is greater than zero. The stop_loss method is implemented to dynamically adjust the stop-loss level based on the current_profit. If the current_profit exceeds certain thresholds, a desired stop-loss level is calculated and returned. Overall, the ElliotV5 strategy combines multiple indicators and moving averages to identify potential buying and selling opportunities in the market. It also incorporates dynamic stop-loss adjustment to manage risk.

The EWO (Elliott Wave Oscillator) indicator is calculated based on the fast_ewo and slow_ewo parameters.

The RSI (Relative Strength Index) is calculated with a time period of 14.

In the populate_buy_trend method, buy signals are generated based on certain conditions. These conditions include the close price being below the moving average multiplied by a low offset, the EWO being above a certain threshold (ewo_high), the RSI being below a certain threshold (rsi_buy), and the volume being greater than zero. In the populate_sell_trend method, sell signals are generated based on the condition that the close price is above the moving average multiplied by a high offset, and the volume is greater than zero. The stop_loss method is implemented to dynamically adjust the stop-loss level based on the current_profit. If the current_profit exceeds certain thresholds, a desired stop-loss level is calculated and returned. Overall, the ElliotV5 strategy combines multiple indicators and moving averages to identify potential buying and selling opportunities in the market. It also incorporates dynamic stop-loss adjustment to manage risk.

stoploss: -0.189 timeframe: 5m hash(sha256): 088cdc6047a9c8e997e1ad4619021e228d1c4049567e2aa0d1b40108543a9338

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08