You will be redirected to the original Strategy in 15 seconds.

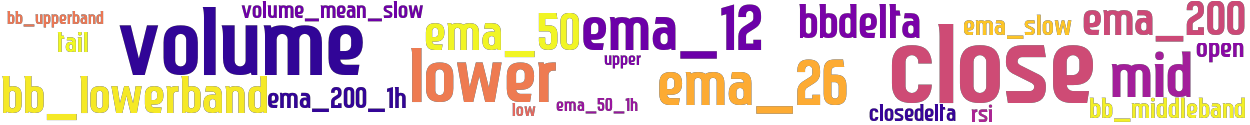

The EMA_Cross strategy is implemented as a class that inherits from the IStrategy class. It consists of three main methods: populate_indicators, populate_buy_trend, and populate_sell_trend. In the populate_indicators method, the strategy calculates and populates various indicators based on the provided dataframe and metadata.

It merges informative data from the 1-hour timeframe and fills any missing values.

The populate_buy_trend method determines the conditions for generating a buy signal.

It sets the 'buy' column of the dataframe to 1 for three different strategies: BinHV45: The close price is above the 200-period exponential moving average (EMA) in the current timeframe and above the 200-period EMA in the 1-hour timeframe. The 50-period EMA is also above the 200-period EMA, and the 50-period EMA in the 1-hour timeframe is above the 200-period EMA in the 1-hour timeframe. Additional conditions involve the lower Bollinger Band, Bollinger Band delta, close price delta, tail, and volume. ClucMay72018: The close price is below a slower EMA, below 98.5% of the lower Bollinger Band, and the volume is lower than the previous slow volume mean multiplied by 20 and the previous volume multiplied by 4. MACD Low buy: The 26-period EMA is above the 12-period EMA, and the difference between them is greater than 2% of the opening price. The difference between the previous values is also greater than 1% of the opening price. Additional conditions involve volume, close price in relation to the lower Bollinger Band, and volume not being zero. The populate_sell_trend method determines the conditions for generating a sell signal. It sets the 'sell' column of the dataframe to 1 when the close price is above 1.01 times the middle Bollinger Band and the volume is not zero. Overall, the strategy uses various technical indicators and their relationships to identify potential buying and selling opportunities in the market.

It merges informative data from the 1-hour timeframe and fills any missing values.

The populate_buy_trend method determines the conditions for generating a buy signal.

It sets the 'buy' column of the dataframe to 1 for three different strategies: BinHV45: The close price is above the 200-period exponential moving average (EMA) in the current timeframe and above the 200-period EMA in the 1-hour timeframe. The 50-period EMA is also above the 200-period EMA, and the 50-period EMA in the 1-hour timeframe is above the 200-period EMA in the 1-hour timeframe. Additional conditions involve the lower Bollinger Band, Bollinger Band delta, close price delta, tail, and volume. ClucMay72018: The close price is below a slower EMA, below 98.5% of the lower Bollinger Band, and the volume is lower than the previous slow volume mean multiplied by 20 and the previous volume multiplied by 4. MACD Low buy: The 26-period EMA is above the 12-period EMA, and the difference between them is greater than 2% of the opening price. The difference between the previous values is also greater than 1% of the opening price. Additional conditions involve volume, close price in relation to the lower Bollinger Band, and volume not being zero. The populate_sell_trend method determines the conditions for generating a sell signal. It sets the 'sell' column of the dataframe to 1 when the close price is above 1.01 times the middle Bollinger Band and the volume is not zero. Overall, the strategy uses various technical indicators and their relationships to identify potential buying and selling opportunities in the market.

stoploss: -0.99 timeframe: 5m hash(sha256): d599d959127b340888062264f9ac2227331ece86f58dcff25fa3547492c8ad2b

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-26 07:50:10