Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The DCBBBounce strategy is a trading strategy that uses various technical indicators to generate buy and sell signals. Here is a summary of what the strategy does:

Indicator Calculation: The strategy starts by calculating multiple technical indicators, including Bollinger Bands, Donchian Channels, Average Directional Index (ADX), Directional Movement indicators (DM), Money Flow Index (MFI), Moving Average Convergence Divergence (MACD), Stochastic Fast, Relative Strength Index (RSI), Fisher Transform of RSI, Exponential Moving Averages (EMA), and Simple Moving Average (SMA). These indicators provide information about price volatility, trends, momentum, and overbought/oversold conditions.

Buy Signal Generation: The strategy defines a set of conditions for generating buy signals.

These conditions include the following: If the Donchian Channel upper value is not null.

If SAR (Stop and Reverse) indicator is enabled and its value is not null, and the closing price is below the SAR value. If SMA (Simple Moving Average) indicator is enabled and its value is not null, and the closing price is above the SMA value. If EMA (Exponential Moving Average) indicator is enabled and its value is not null, and the closing price is above the EMA50 value. If ADX (Average Directional Index) indicator is enabled and its value is greater than a specified threshold, and the positive directional movement (DM+) is greater than or equal to the negative directional movement (DM-). If the lower difference between the Donchian Channel and Bollinger Bands is not null, the closing price is greater than or equal to the opening price, and the lower difference crosses above zero. Sell Signal Generation: The strategy determines sell signals based on the following condition: If the upper difference between the Donchian Channel and Bollinger Bands is not null, and the upper difference crosses below zero. Signal Population: The strategy populates the "buy" and "sell" columns in the dataframe according to the generated buy and sell signals. Overall, the DCBBBounce strategy combines multiple indicators to identify potential buying opportunities when certain conditions are met and to signal selling opportunities when other conditions are satisfied.

Buy Signal Generation: The strategy defines a set of conditions for generating buy signals.

These conditions include the following: If the Donchian Channel upper value is not null.

If SAR (Stop and Reverse) indicator is enabled and its value is not null, and the closing price is below the SAR value. If SMA (Simple Moving Average) indicator is enabled and its value is not null, and the closing price is above the SMA value. If EMA (Exponential Moving Average) indicator is enabled and its value is not null, and the closing price is above the EMA50 value. If ADX (Average Directional Index) indicator is enabled and its value is greater than a specified threshold, and the positive directional movement (DM+) is greater than or equal to the negative directional movement (DM-). If the lower difference between the Donchian Channel and Bollinger Bands is not null, the closing price is greater than or equal to the opening price, and the lower difference crosses above zero. Sell Signal Generation: The strategy determines sell signals based on the following condition: If the upper difference between the Donchian Channel and Bollinger Bands is not null, and the upper difference crosses below zero. Signal Population: The strategy populates the "buy" and "sell" columns in the dataframe according to the generated buy and sell signals. Overall, the DCBBBounce strategy combines multiple indicators to identify potential buying opportunities when certain conditions are met and to signal selling opportunities when other conditions are satisfied.

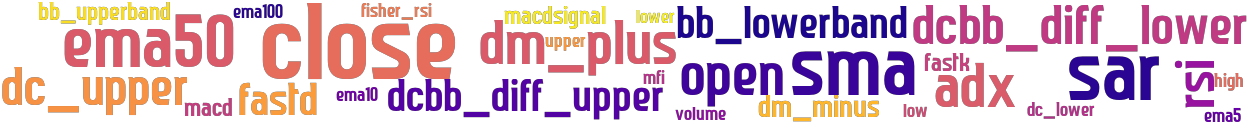

stoploss: -0.333 timeframe: 5m hash(sha256): 8447c7afc4091c713b9882b6fc368c0a56ba3212b4297a9394c5d28f84a20441 indicators: upper close bb_lowerband mfi ema5 fastk sma dcbb_diff_lower volume open fastd dm_plus ema10 sar high macdsignal dc_upper fisher_rsi dc_lower ema100 dcbb_diff_upper macd adx lower rsi bb_upperband low ema50 dm_minus

Similar Strategies: (based on used indicators)

Strategy: DonchianBounce, Similarity Score: 86.67%

Strategy: DonchianBounce_2, Similarity Score: 86.67%

Strategy: DonchianChannel, Similarity Score: 86.67%

Strategy: DonchianChannel_2, Similarity Score: 86.67%

last change: 2023-02-08 04:36:00