You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix_hhll strategy is designed to backtest trading signals based on various indicators. Here's a short description of what the strategy does:

It populates indicators using the provided dataframe and metadata. It calculates Heikin-Ashi candles (ha_open, ha_close, ha_high, ha_low) based on the input dataframe.

It calculates Bollinger Bands (mid, lower) using the Heikin-Ashi close price and a window size of 40 with 2 standard deviations.

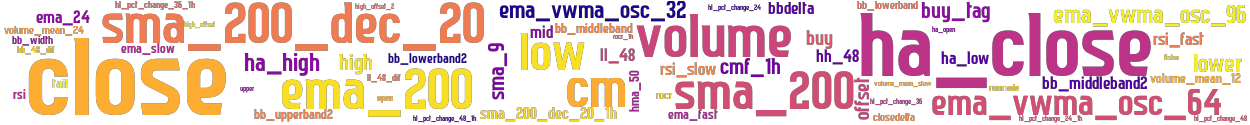

It calculates additional indicators such as bbdelta, closedelta, tail, bb_lowerband, bb_middleband, bb_lowerband2, bb_middleband2, bb_upperband2, bb_width, ema_fast, ema_slow, ema_24, ema_200, sma_9, sma_200, hma_50, volume_mean_12, volume_mean_24, volume_mean_slow, rocr, hh_48, hh_48_diff, ll_48, ll_48_diff, rsi, fisher, rsi_fast, rsi_slow, sma_200_dec_20, ema_vwma_osc_32, ema_vwma_osc_64, ema_vwma_osc_96, and cmf.

It retrieves an informative dataframe based on the '1h' timeframe and merges it with the original dataframe using the merge_informative_pair function. It populates the buy trend by setting the 'buy' column to 1 for certain conditions based on the indicators. It populates the sell trend by setting the 'sell' column to 1 for certain conditions based on the indicators. It defines a function for calculating the Volume Weighted Moving Average (VWMA). It defines a function for calculating the rolling percentage change maximum across a specified interval, either high to low (HL) or open to close (OC). This strategy combines multiple indicators to generate buy and sell signals based on specific conditions.

It calculates Bollinger Bands (mid, lower) using the Heikin-Ashi close price and a window size of 40 with 2 standard deviations.

It calculates additional indicators such as bbdelta, closedelta, tail, bb_lowerband, bb_middleband, bb_lowerband2, bb_middleband2, bb_upperband2, bb_width, ema_fast, ema_slow, ema_24, ema_200, sma_9, sma_200, hma_50, volume_mean_12, volume_mean_24, volume_mean_slow, rocr, hh_48, hh_48_diff, ll_48, ll_48_diff, rsi, fisher, rsi_fast, rsi_slow, sma_200_dec_20, ema_vwma_osc_32, ema_vwma_osc_64, ema_vwma_osc_96, and cmf.

It retrieves an informative dataframe based on the '1h' timeframe and merges it with the original dataframe using the merge_informative_pair function. It populates the buy trend by setting the 'buy' column to 1 for certain conditions based on the indicators. It populates the sell trend by setting the 'sell' column to 1 for certain conditions based on the indicators. It defines a function for calculating the Volume Weighted Moving Average (VWMA). It defines a function for calculating the rolling percentage change maximum across a specified interval, either high to low (HL) or open to close (OC). This strategy combines multiple indicators to generate buy and sell signals based on specific conditions.

stoploss: -0.99 timeframe: 5m hash(sha256): 319c66ded49b5b03dd74478cf8e52ae1bb2878c8c85234f3b970f5f6ae1eb7dc

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-11 00:37:40