You will be redirected to the original Strategy in 15 seconds.

The ClucHAnix trading strategy is a backtesting strategy that uses various indicators to make buy and sell decisions in the cryptocurrency market. Here is a brief description of what the strategy does:

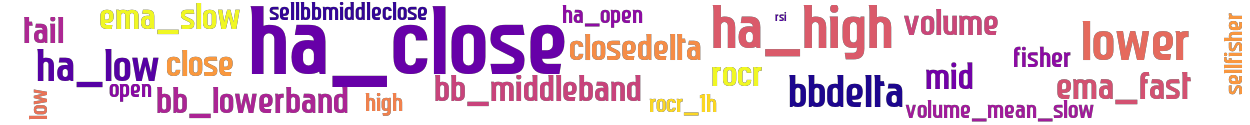

Populate Indicators: This function calculates and adds several indicators to the input dataframe, including Heikin-Ashi candlestick data, Bollinger Bands, moving averages (EMA), volume mean, rate of change ratio (ROCR), relative strength index (RSI), and Fisher Transform. Populate Buy Trend: This function determines the conditions for initiating a buy signal.

It checks if the rate of change (ROCR) in the past hour is above a specified threshold, and if certain conditions related to Bollinger Bands, closing price delta, tail, and the relationship between the closing price and lower Bollinger Band are met.

If the conditions are satisfied, a "buy" signal is generated.

Populate Sell Trend: This function determines the conditions for initiating a sell signal. It checks if the Fisher Transform value exceeds a specified threshold, and if certain conditions related to the high and closing prices, moving averages, and volume are met. If the conditions are satisfied, a "sell" signal is generated. The class "ClucHAnix_ETH" is a subclass that extends the functionality of the base "ClucHAnix" strategy specifically for Ethereum (ETH) trading. Overall, the strategy utilizes a combination of technical indicators to identify potential buying and selling opportunities in the cryptocurrency market based on predefined conditions.

It checks if the rate of change (ROCR) in the past hour is above a specified threshold, and if certain conditions related to Bollinger Bands, closing price delta, tail, and the relationship between the closing price and lower Bollinger Band are met.

If the conditions are satisfied, a "buy" signal is generated.

Populate Sell Trend: This function determines the conditions for initiating a sell signal. It checks if the Fisher Transform value exceeds a specified threshold, and if certain conditions related to the high and closing prices, moving averages, and volume are met. If the conditions are satisfied, a "sell" signal is generated. The class "ClucHAnix_ETH" is a subclass that extends the functionality of the base "ClucHAnix" strategy specifically for Ethereum (ETH) trading. Overall, the strategy utilizes a combination of technical indicators to identify potential buying and selling opportunities in the cryptocurrency market based on predefined conditions.

stoploss: -0.99 timeframe: 1m hash(sha256): 99a52eaeda7fce44ce488443cabb437e3529848ab9c67cc672d415b78ab14713

Was not able to fetch indicators from Strategyfile.

last change: 2022-07-02 19:54:08