The BigTrader strategy is designed to backtest trading decisions based on a combination of technical indicators. Here's a breakdown of how the strategy works:

populate_indicators function:

This function calculates the Simple Moving Average (SMA) with a time period of 15 for the given dataframe. The SMA is a commonly used indicator that smooths out price data over a specific time period to identify trends.

populate_buy_trend function: This function populates the buy column of the dataframe with values indicating potential buy signals.

The buy conditions are as follows: The current closing price is less than the 15-period SMA multiplied by a certain low_offset.

The current closing price is higher than the closing price 4 periods ago. The closing price 8 periods ago is higher than the closing price 4 periods ago. The closing price 12 periods ago is higher than the closing price 8 periods ago. The volume is greater than zero. populate_sell_trend function: This function populates the sell column of the dataframe with values indicating potential sell signals. The sell conditions are as follows: The current opening price is higher than the 15-period SMA multiplied by a certain high_offset. The opening price is lower than the closing price 4 periods ago. The closing price 8 periods ago is lower than the closing price 4 periods ago. The closing price 12 periods ago is lower than the closing price 8 periods ago. The volume is greater than zero. Overall, the BigTrader strategy uses the SMA indicator and specific conditions related to price and volume to determine potential buy and sell signals. The strategy aims to capture trends and exploit price movements in the financial market. Keep in mind that this description is a simplified explanation, and further details about risk management and other factors may be necessary for a comprehensive understanding of the strategy.

populate_buy_trend function: This function populates the buy column of the dataframe with values indicating potential buy signals.

The buy conditions are as follows: The current closing price is less than the 15-period SMA multiplied by a certain low_offset.

The current closing price is higher than the closing price 4 periods ago. The closing price 8 periods ago is higher than the closing price 4 periods ago. The closing price 12 periods ago is higher than the closing price 8 periods ago. The volume is greater than zero. populate_sell_trend function: This function populates the sell column of the dataframe with values indicating potential sell signals. The sell conditions are as follows: The current opening price is higher than the 15-period SMA multiplied by a certain high_offset. The opening price is lower than the closing price 4 periods ago. The closing price 8 periods ago is lower than the closing price 4 periods ago. The closing price 12 periods ago is lower than the closing price 8 periods ago. The volume is greater than zero. Overall, the BigTrader strategy uses the SMA indicator and specific conditions related to price and volume to determine potential buy and sell signals. The strategy aims to capture trends and exploit price movements in the financial market. Keep in mind that this description is a simplified explanation, and further details about risk management and other factors may be necessary for a comprehensive understanding of the strategy.

startup_candle_count : 60 Recursive Analysis found no issues while using 60 startup_candle_count

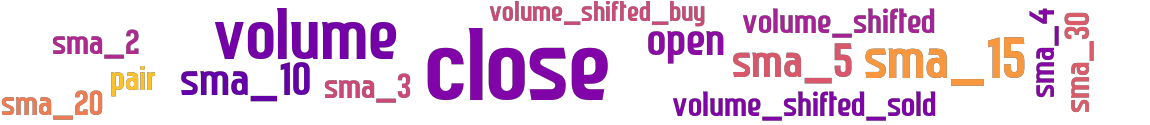

stoploss: -0.5 timeframe: 5m hash(sha256): 42430e7f3c622387cfc661ec10fefecf89e051d8422e43d8c382ce2ab3c224fd indicators: open sma_15 close volume

No similar strategies found. (based on used indicators)

last change: 2024-05-02 11:54:47