The BHMWHOV10 strategy is a backtesting trading strategy implemented in Python. This strategy involves the use of various technical indicators to identify potential buy and sell signals in financial markets. Here's a breakdown of its key components:

1.

Indicator Population: Exponential Moving Averages (EMA): Calculates EMA trends for different time periods (ranging from 50 to 130 with an interval of 20, and from 140 to 320 with an interval of 20) and stores them as features in the dataframe.

EWO (Elliott Wave Oscillator): Computes the EWO for different combinations of base and step values (ranging from 50 to 170 with an interval of 10 for both base and step).

Bollinger Bands (BB): Calculates Bollinger Bands for a window of 40 and 2 standard deviations. Computes metrics related to the Bollinger Bands, such as 'lower', 'mid', 'bbwidth', 'space', 'bbdelta', 'bottomdelta', 'topdelta', and 'tail'. 2. Buy Trend Criteria: The strategy establishes conditions for buy signals: EMA Trend Condition: The EMA trend for a specified period should be higher than the slow EMA for the same period. EMA Rise Condition: The slow EMA should be rising over a specific interval. EWO Condition: The calculated EWO value should be higher than a specified threshold. Bollinger Bands Conditions: Several conditions based on Bollinger Bands metrics, such as 'space', 'bottom', 'lower', 'bbdelta', 'tail', 'bottomdelta', 'topdelta', and 'volume'. These conditions evaluate factors like price range, band width, and volume. 3. Sell Trend Criteria: The strategy establishes conditions for sell signals: Price Above Mid-BB Condition: The closing price should be above the mid value of the Bollinger Bands, adjusted by a specified offset. Volume Condition: The trading volume should be above 0. Note: The strategy uses various parameters such as EMA periods, EWO values, Bollinger Bands parameters, and threshold values for buy and sell signals. These parameters can be adjusted to fine-tune the strategy's performance. This trading strategy aims to capture potential trends and reversals in the market by combining signals from different technical indicators. It's important to thoroughly test and validate the strategy's performance using historical data before considering its application in a real trading environment.

Indicator Population: Exponential Moving Averages (EMA): Calculates EMA trends for different time periods (ranging from 50 to 130 with an interval of 20, and from 140 to 320 with an interval of 20) and stores them as features in the dataframe.

EWO (Elliott Wave Oscillator): Computes the EWO for different combinations of base and step values (ranging from 50 to 170 with an interval of 10 for both base and step).

Bollinger Bands (BB): Calculates Bollinger Bands for a window of 40 and 2 standard deviations. Computes metrics related to the Bollinger Bands, such as 'lower', 'mid', 'bbwidth', 'space', 'bbdelta', 'bottomdelta', 'topdelta', and 'tail'. 2. Buy Trend Criteria: The strategy establishes conditions for buy signals: EMA Trend Condition: The EMA trend for a specified period should be higher than the slow EMA for the same period. EMA Rise Condition: The slow EMA should be rising over a specific interval. EWO Condition: The calculated EWO value should be higher than a specified threshold. Bollinger Bands Conditions: Several conditions based on Bollinger Bands metrics, such as 'space', 'bottom', 'lower', 'bbdelta', 'tail', 'bottomdelta', 'topdelta', and 'volume'. These conditions evaluate factors like price range, band width, and volume. 3. Sell Trend Criteria: The strategy establishes conditions for sell signals: Price Above Mid-BB Condition: The closing price should be above the mid value of the Bollinger Bands, adjusted by a specified offset. Volume Condition: The trading volume should be above 0. Note: The strategy uses various parameters such as EMA periods, EWO values, Bollinger Bands parameters, and threshold values for buy and sell signals. These parameters can be adjusted to fine-tune the strategy's performance. This trading strategy aims to capture potential trends and reversals in the market by combining signals from different technical indicators. It's important to thoroughly test and validate the strategy's performance using historical data before considering its application in a real trading environment.

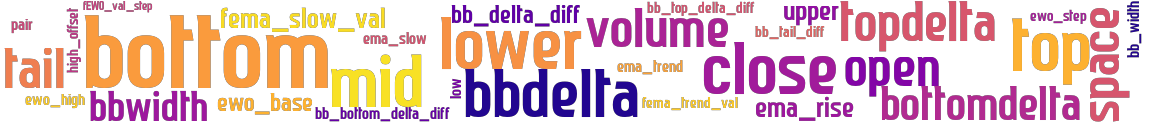

stoploss: -0.3 timeframe: 5m hash(sha256): 15e22bff89ea9019cd957c8271282c51c6ccb09d3265dfd39bc4ead7f521361a indicators: upper ewo_high EWO_val_step close tail bbwidth bbdelta volume high_offset open ema_trend ema_rise mid bb_bottom_delta_dif bb_width ema_trend_val open close ewo_step ewo_base bottomdelta bb_delta_dif bb_top_delta_dif lower bb_tail_dif top ema_slow_val ema_slow low bottom space topdelta

Similar Strategies: (based on used indicators)

Strategy: BHMWHOV0, Similarity Score: 96.97%

Strategy: BinHModWhiteHOV0, Similarity Score: 87.88%

last change: 2024-04-29 03:00:24