You will be redirected to the original Strategy in 15 seconds.

The BBRSIv2 strategy is a trading strategy that combines Bollinger Bands (BB) and Relative Strength Index (RSI) indicators to generate buy and sell signals. Here is a breakdown of what the strategy does:

Minimal ROI and stoploss: The strategy sets a minimal ROI (Return on Investment) of 0.3, which represents the minimum desired profit. The stoploss is set at -0.99, indicating a maximum tolerable loss before selling a position.

Candle processing and sell conditions: The strategy is designed to process only new candles, meaning it focuses on the most recent market data.

It uses a sell signal and sells only when there is a profit, as specified by the sell_profit_only parameter.

The sell_profit_offset parameter determines the profit threshold required for selling. The strategy also has the option to ignore the minimal ROI if a buy signal is generated. Custom stoploss: The strategy implements a custom stoploss function that adjusts the stoploss value based on the current profit of a trade. The stoploss value decreases as the profit increases, indicating a trailing stoploss mechanism. Timeframe and indicators: The strategy is optimized for a 15-minute timeframe. It uses several indicators to make trading decisions. The Relative Strength Index (RSI) with a time period of 14 is calculated to measure overbought and oversold conditions. Bollinger Bands are used to identify price volatility, with the middle band representing the moving average and the upper and lower bands showing standard deviations. The Triple Exponential Moving Average (TEMA) is also calculated using a time period of 9. Plot configuration: The strategy provides a plot configuration that visualizes the Bollinger Bands, TEMA, RSI, and additional market data. The RSI subplot shows the RSI values with a blue color. The MARKET subplot displays the maximum and minimum closing prices, as well as the percentage drop and pump of the price. Buy and sell conditions: The strategy defines several buy and sell conditions based on the calculated indicators. The buy conditions include crossing above 35 for RSI and the close price being below the lower Bollinger Band (BB_LOWER). Another buy condition involves RSI being below 23, TEMA being below the lower Bollinger Band, TEMA being higher than the previous value, and positive trading volume. Exit conditions: The strategy defines sell conditions based on RSI being above 70 (RS1) and the current price being higher than the maximum closing price (RS2). Overall, the BBRSIv2 strategy combines Bollinger Bands, RSI, and additional conditions to identify potential buying and selling opportunities in the market.

Candle processing and sell conditions: The strategy is designed to process only new candles, meaning it focuses on the most recent market data.

It uses a sell signal and sells only when there is a profit, as specified by the sell_profit_only parameter.

The sell_profit_offset parameter determines the profit threshold required for selling. The strategy also has the option to ignore the minimal ROI if a buy signal is generated. Custom stoploss: The strategy implements a custom stoploss function that adjusts the stoploss value based on the current profit of a trade. The stoploss value decreases as the profit increases, indicating a trailing stoploss mechanism. Timeframe and indicators: The strategy is optimized for a 15-minute timeframe. It uses several indicators to make trading decisions. The Relative Strength Index (RSI) with a time period of 14 is calculated to measure overbought and oversold conditions. Bollinger Bands are used to identify price volatility, with the middle band representing the moving average and the upper and lower bands showing standard deviations. The Triple Exponential Moving Average (TEMA) is also calculated using a time period of 9. Plot configuration: The strategy provides a plot configuration that visualizes the Bollinger Bands, TEMA, RSI, and additional market data. The RSI subplot shows the RSI values with a blue color. The MARKET subplot displays the maximum and minimum closing prices, as well as the percentage drop and pump of the price. Buy and sell conditions: The strategy defines several buy and sell conditions based on the calculated indicators. The buy conditions include crossing above 35 for RSI and the close price being below the lower Bollinger Band (BB_LOWER). Another buy condition involves RSI being below 23, TEMA being below the lower Bollinger Band, TEMA being higher than the previous value, and positive trading volume. Exit conditions: The strategy defines sell conditions based on RSI being above 70 (RS1) and the current price being higher than the maximum closing price (RS2). Overall, the BBRSIv2 strategy combines Bollinger Bands, RSI, and additional conditions to identify potential buying and selling opportunities in the market.

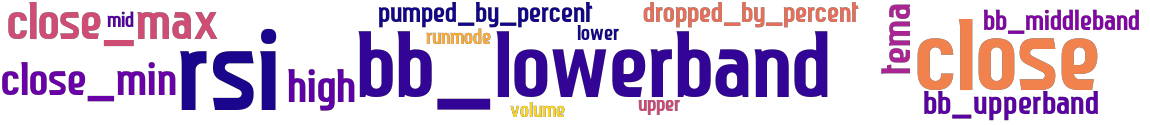

stoploss: -0.99 timeframe: 15m hash(sha256): 35ae832a078229ab3f97fd9c7111f027b7ddec96898e60dc272875d0a684d82b indicators: close_min high upper mid lower tema volume bb_middleband rsi close_max close pumped_by_percent bb_upperband bb_lowerband runmode dropped_by_percent

Similar Strategies: (based on used indicators)

Strategy: Discord_BBRSIv2, Similarity Score: 94.12%

last change: 2023-03-24 06:30:40