Not Enough Data to display!

Average Overall

| Not Enough Data! / Avg statistics not populated yet. |

|---|

The BBMod strategy is a trading strategy that uses various indicators to determine entry signals in the market. Here's a breakdown of what the strategy does:

It calculates Bollinger Bands with two standard deviations (bb_lowerband2, bb_middleband2, bb_upperband2) and with three standard deviations (bb_lowerband3, bb_middleband3, bb_upperband3). It calculates the width of the Bollinger Bands (bb_width) as the percentage difference between the upper and lower bands divided by the middle band.

It calculates the delta between the lower bands of Bollinger Bands with two and three standard deviations (bb_delta).

It calculates the absolute difference between the closing prices of consecutive periods (closedelta).

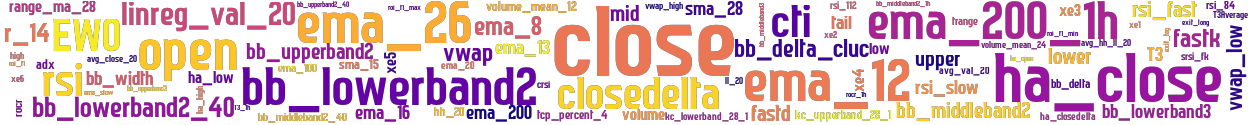

It calculates the Simple Moving Averages (SMA) with periods of 15 and 28 (sma_15, sma_28). It calculates the Commodity Channel Index (CCI) with various lengths (cci_length_X). It calculates the Relative Momentum Index (RMI) with various lengths (rmi_length_X). It calculates the Stochastic RSI (srsi_fk) with parameters (15, 20, 2, 2). It calculates the True Range (trange). It calculates the Keltner Channels with a period of 28 (kc_upperband_28_1, kc_lowerband_28_1). It calculates the Highest High (hh_20) and Lowest Low (ll_20) over a period of 20. It calculates the average of the Highest High and Lowest Low (avg_hh_ll_20). It calculates the average of the closing price and the average of the Highest High and Lowest Low (avg_close_20, avg_val_20). It calculates the linear regression value of the difference between the closing price and the average value (linreg_val_20). It calculates the 12-period and 24-period rolling averages of volume (volume_mean_12, volume_mean_24). It calculates the Williams %R (r_14). It calculates the Stochastic Fast %D (fastd) and %K (fastk). It calculates the Average Directional Index (adx). It calculates the T3 moving average (T3). The strategy then uses these indicators to define entry conditions in different trend scenarios. The conditions include checks on Bollinger Bands, Keltner Channels, linear regression values, Exponential Moving Averages (EMA), EWO, RSI, and other factors specific to each scenario. Please note that the strategy code provided might be incomplete or might have errors, as it's only a portion of the complete code.

It calculates the delta between the lower bands of Bollinger Bands with two and three standard deviations (bb_delta).

It calculates the absolute difference between the closing prices of consecutive periods (closedelta).

It calculates the Simple Moving Averages (SMA) with periods of 15 and 28 (sma_15, sma_28). It calculates the Commodity Channel Index (CCI) with various lengths (cci_length_X). It calculates the Relative Momentum Index (RMI) with various lengths (rmi_length_X). It calculates the Stochastic RSI (srsi_fk) with parameters (15, 20, 2, 2). It calculates the True Range (trange). It calculates the Keltner Channels with a period of 28 (kc_upperband_28_1, kc_lowerband_28_1). It calculates the Highest High (hh_20) and Lowest Low (ll_20) over a period of 20. It calculates the average of the Highest High and Lowest Low (avg_hh_ll_20). It calculates the average of the closing price and the average of the Highest High and Lowest Low (avg_close_20, avg_val_20). It calculates the linear regression value of the difference between the closing price and the average value (linreg_val_20). It calculates the 12-period and 24-period rolling averages of volume (volume_mean_12, volume_mean_24). It calculates the Williams %R (r_14). It calculates the Stochastic Fast %D (fastd) and %K (fastk). It calculates the Average Directional Index (adx). It calculates the T3 moving average (T3). The strategy then uses these indicators to define entry conditions in different trend scenarios. The conditions include checks on Bollinger Bands, Keltner Channels, linear regression values, Exponential Moving Averages (EMA), EWO, RSI, and other factors specific to each scenario. Please note that the strategy code provided might be incomplete or might have errors, as it's only a portion of the complete code.

startup_candle_count : 200 ema_100: -0.026% rsi_slow: 0.002% rsi_84: 1.849% rsi_112: 2.118%

stoploss: -0.99 timeframe: 5m hash(sha256): f356bec64b1c29060f861a57d1c9c16f9aa41589a137f9158bc1d330ca1602d8 indicators: upper close exit_long exit_tag volume_mean_12 ema_200_1h avg_val_20 rsi_fast volume xe1 ema_20 ha_closedelta trange bb_upperband2 volume_mean_24 high ema_8 roi_t1_max bb_lowerband3 xe6 ha_high adx ema_12 sma_28 T3Average ema_slow ema_26 bb_lowerband2_40 bb_upperband2_40 bb_middleband2 closedelta sma_15 ha_open tcp_percent_4 avg_close_20 rmi_length_val vwap lower T3 rsi T3_1h xe3 ll_20 hh_20 kc_lowerband_28_1 bb_middleband3 bb_upperband3 tail bb_middleband2_1h srsi_fk r_14 rsi_84 roi_t1_min vwap_

Similar Strategies: (based on used indicators)

Strategy: BBMod_5, Similarity Score: 94.55%

Strategy: BBMod_7, Similarity Score: 87.27%

Strategy: BBMod_3, Similarity Score: 81.82%

last change: 2023-06-27 13:39:20