The BBKCBounce strategy is a trading strategy that uses various technical analysis (TA) indicators to generate buy and sell signals for a given financial instrument. Here is a breakdown of what the strategy does:

populate_indicators function:

Adds several TA indicators to the input DataFrame, such as Simple Moving Average (SMA), Exponential Moving Average (EMA), Triple Exponential Moving Average (TEMA), Moving Average Convergence Divergence (MACD), Money Flow Index (MFI), Average Directional Index (ADX), Directional Movement indicators (DM), Parabolic SAR (SAR), Relative Strength Index (RSI), Fisher Transform of RSI (fisher_rsi), Bollinger Bands (bb_upperband, bb_mid, bb_lowerband), and Keltner Channels (kc_upper, kc_lower, kc_middle, kc_gain). populate_buy_trend function:

Determines the buy signals based on certain conditions:

ADX condition: If the ADX value is greater than or equal to a specified threshold.

DM Delta condition: If the difference between the DM Plus and DM Minus values is greater than 0.

MFI condition: If the Money Flow Index value is greater than a specified threshold.

SAR condition: If the close price is below the Parabolic SAR value. MACD condition: If the MACD value is greater than the MACD signal value. Fisher RSI condition: If the Fisher Transform of RSI value is less than a specified threshold. Close price condition: If the close price is greater than the open price. Keltner Channels and Bollinger Bands condition: If the close price crosses above the lower bands of both indicators and remains above them. populate_sell_trend function: Determines the sell signals based on certain conditions: Hold condition: If the sell hold option is enabled, no sell signal is generated (sell column is set to 0) for all close prices. Upper Band condition: If the close price crosses above the upper bands of both Keltner Channels and Bollinger Bands and remains above them. The strategy utilizes these indicators and conditions to identify potential buying opportunities (buy signals) and selling opportunities (sell signals) in the market, which can be used for backtesting and evaluating the performance of the strategy.

DM Delta condition: If the difference between the DM Plus and DM Minus values is greater than 0.

MFI condition: If the Money Flow Index value is greater than a specified threshold.

SAR condition: If the close price is below the Parabolic SAR value. MACD condition: If the MACD value is greater than the MACD signal value. Fisher RSI condition: If the Fisher Transform of RSI value is less than a specified threshold. Close price condition: If the close price is greater than the open price. Keltner Channels and Bollinger Bands condition: If the close price crosses above the lower bands of both indicators and remains above them. populate_sell_trend function: Determines the sell signals based on certain conditions: Hold condition: If the sell hold option is enabled, no sell signal is generated (sell column is set to 0) for all close prices. Upper Band condition: If the close price crosses above the upper bands of both Keltner Channels and Bollinger Bands and remains above them. The strategy utilizes these indicators and conditions to identify potential buying opportunities (buy signals) and selling opportunities (sell signals) in the market, which can be used for backtesting and evaluating the performance of the strategy.

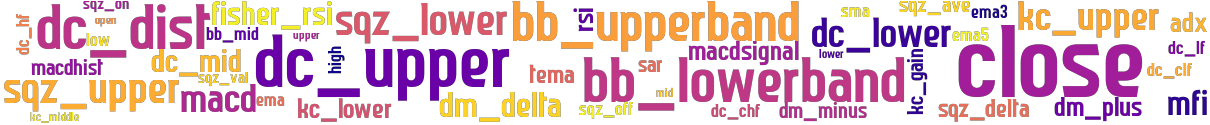

stoploss: 0 timeframe: 5m hash(sha256): adc64e9872890862d5312524a2cc7e03b87b6b861e7c5dc059265e66bd185610 indicators: upper tema kc_lower close dm_delta mfi bb_lowerband ema5 kc_gain macdhist sma open dm_plus sar macdsignal ema mid fisher_rsi macd ema3 adx lower kc_middle kc_upper rsi bb_upperband dm_minus bb_mid

Similar Strategies: (based on used indicators)

Strategy: SqueezeMomentum_2, Similarity Score: 93.1%

Strategy: SqueezeMomentum_3, Similarity Score: 93.1%

Strategy: SqueezeOff, Similarity Score: 89.66%

Strategy: SqueezeOff_2, Similarity Score: 89.66%

Strategy: Squeeze002, Similarity Score: 86.21%

Strategy: Squeeze002_2, Similarity Score: 86.21%

last change: 2024-04-28 04:32:01