The NostalgiaForInfinityV2_OPT_02 strategy is a trading strategy that aims to generate buy and sell signals based on various indicators and conditions. Here is a breakdown of what the strategy does:

populate_indicators: This function is responsible for populating the indicators used in the strategy. It merges the 1-hour informative indicators with the main timeframe indicators.

populate_buy_trend: This function generates buy signals based on multiple conditions.

The strategy looks for opportunities to buy when the following conditions are met: The closing price is below the 9-period simple moving average (sma_9).

The closing price is above the 200-period exponential moving average (ema_200_1h) of the 1-hour timeframe. The 50-period exponential moving average (ema_50) is above the 200-period exponential moving average (ema_200). The 50-period exponential moving average (ema_50_1h) of the 1-hour timeframe is above the 200-period exponential moving average (ema_200_1h). The lower Bollinger Band (bbdelta) is positive. The Bollinger Band delta (bbdelta) is greater than a percentage of the closing price (self.buy_bb40_bbdelta_close.value). The Bollinger Band delta (bbdelta) is greater than a percentage of the closing price (self.buy_bb40_closedelta_close.value). The tail value is less than the Bollinger Band delta (bbdelta) multiplied by a percentage (self.buy_bb40_tail_bbdelta.value). The closing price is below the previous lower Bollinger Band value. The closing price is less than or equal to the previous closing price. The volume is greater than 0. OR The closing price is below the 9-period simple moving average (sma_9). The closing price is above the 200-period exponential moving average (ema_200). The closing price is above the 200-period exponential moving average (ema_200_1h) of the 1-hour timeframe. The closing price is below the slow exponential moving average (ema_slow). The closing price is below a percentage (self.buy_bb20_close_bblowerband.value) of the lower Bollinger Band value. The volume is less than the previous slow volume mean multiplied by a percentage (self.buy_bb20_volume.value). populate_sell_trend: This function generates sell signals based on multiple conditions. The strategy looks for opportunities to sell when the following conditions are met: The relative strength index (rsi) is above a specified value (self.sell_rsi_bb.value). The closing price is above the upper Bollinger Band (bb_upperband), and the previous two closing prices were also above their respective upper Bollinger Bands. The volume is greater than 0. OR The relative strength index (rsi) is above a specified value (self.sell_rsi_main.value). The volume is greater than 0. OR The closing price is below the 200-period exponential moving average (ema_200) and above the 50-period exponential moving average (ema_50). The relative strength index (rsi) is above a specified value (self.sell_rsi_2.value). The volume is greater than 0. OR The closing price is below the 200-period exponential moving average (ema_200). The difference between the 200-period exponential moving average (ema_200) and the closing price relative to the closing price is below a specified value (self.sell_ema_relative.value). The relative strength index (rsi) is above the 1-hour timeframe relative strength index (rsi_1h) plus a specified value (self.sell_rsi_diff.value). The volume is greater than 0. The strategy assigns a value of 1 to the "buy" or "sell" column of the dataframe to indicate the corresponding signals.

populate_buy_trend: This function generates buy signals based on multiple conditions.

The strategy looks for opportunities to buy when the following conditions are met: The closing price is below the 9-period simple moving average (sma_9).

The closing price is above the 200-period exponential moving average (ema_200_1h) of the 1-hour timeframe. The 50-period exponential moving average (ema_50) is above the 200-period exponential moving average (ema_200). The 50-period exponential moving average (ema_50_1h) of the 1-hour timeframe is above the 200-period exponential moving average (ema_200_1h). The lower Bollinger Band (bbdelta) is positive. The Bollinger Band delta (bbdelta) is greater than a percentage of the closing price (self.buy_bb40_bbdelta_close.value). The Bollinger Band delta (bbdelta) is greater than a percentage of the closing price (self.buy_bb40_closedelta_close.value). The tail value is less than the Bollinger Band delta (bbdelta) multiplied by a percentage (self.buy_bb40_tail_bbdelta.value). The closing price is below the previous lower Bollinger Band value. The closing price is less than or equal to the previous closing price. The volume is greater than 0. OR The closing price is below the 9-period simple moving average (sma_9). The closing price is above the 200-period exponential moving average (ema_200). The closing price is above the 200-period exponential moving average (ema_200_1h) of the 1-hour timeframe. The closing price is below the slow exponential moving average (ema_slow). The closing price is below a percentage (self.buy_bb20_close_bblowerband.value) of the lower Bollinger Band value. The volume is less than the previous slow volume mean multiplied by a percentage (self.buy_bb20_volume.value). populate_sell_trend: This function generates sell signals based on multiple conditions. The strategy looks for opportunities to sell when the following conditions are met: The relative strength index (rsi) is above a specified value (self.sell_rsi_bb.value). The closing price is above the upper Bollinger Band (bb_upperband), and the previous two closing prices were also above their respective upper Bollinger Bands. The volume is greater than 0. OR The relative strength index (rsi) is above a specified value (self.sell_rsi_main.value). The volume is greater than 0. OR The closing price is below the 200-period exponential moving average (ema_200) and above the 50-period exponential moving average (ema_50). The relative strength index (rsi) is above a specified value (self.sell_rsi_2.value). The volume is greater than 0. OR The closing price is below the 200-period exponential moving average (ema_200). The difference between the 200-period exponential moving average (ema_200) and the closing price relative to the closing price is below a specified value (self.sell_ema_relative.value). The relative strength index (rsi) is above the 1-hour timeframe relative strength index (rsi_1h) plus a specified value (self.sell_rsi_diff.value). The volume is greater than 0. The strategy assigns a value of 1 to the "buy" or "sell" column of the dataframe to indicate the corresponding signals.

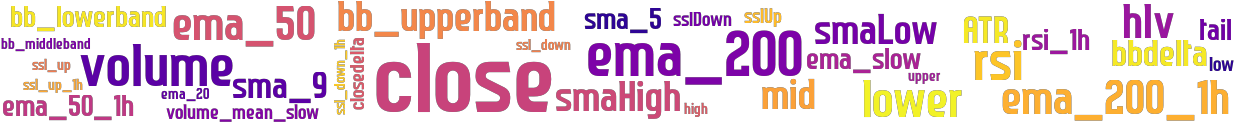

stoploss: -1 timeframe: 5m hash(sha256): e85e17217a3759bc186806ae96666b75ee4074e3d566a8cc6e9d51a7f8fe741e indicators: upper ema_200 ema_50 close sma_5 tail bb_lowerband ema_200_1h bbdelta volume smaHigh ATR ssl_up closedelta sslDown ema_20 hlv volume_mean_slow ema_50_1h smaLow high sslUp mid ssl_down_1h ssl_down rsi_1h sma_9 lower bb_middleband rsi bb_upperband ema_slow low ssl_up_1h

Similar Strategies: (based on used indicators)

Strategy: 08_NostalgiaForInfinityV2_OPT, Similarity Score: 97.14%

Strategy: NostalgiaForInfinityV1, Similarity Score: 97.14%

Strategy: NostalgiaForInfinityV2, Similarity Score: 97.14%

Strategy: 01_CombinedBinHAndClucV7_OPT, Similarity Score: 94.29%

Strategy: 01_CombinedBinHAndClucV7_OPT_02, Similarity Score: 94.29%

Strategy: 02_CombinedBinHClucAndMADV5, Similarity Score: 94.29%

Strategy: 04_CombinedBinHAndClucV8, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV6, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV6_2, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV7, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV7_702, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8Hyper, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8XH, Similarity Score: 94.29%

Strategy: CombinedBinHAndClucV8XHO, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndMADV5, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndMADV5_2, Similarity Score: 94.29%

Strategy: Discord_1_TEST, Similarity Score: 94.29%

Strategy: Discord_1_test, Similarity Score: 94.29%

Strategy: Discord_Bzed, Similarity Score: 94.29%

Strategy: CombinedBinHClucAndSMAOffset, Similarity Score: 91.43%

Strategy: CombinedBinHClucAndSMAOffset_2, Similarity Score: 91.43%

Strategy: HybridMonster, Similarity Score: 88.57%

Strategy: 02_CombinedBinHClucAndMADV6, Similarity Score: 85.71%

Strategy: FrankenStrat, Similarity Score: 85.71%

Strategy: FrankenStrat_259, Similarity Score: 85.71%

Strategy: MACD_23, Similarity Score: 85.71%

Strategy: 06_CombinedBinHAndClucV9, Similarity Score: 82.86%

Strategy: CBPete9, Similarity Score: 82.86%

Strategy: CombinedAMD, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_269, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_5, Similarity Score: 82.86%

Strategy: CombinedBinHClucAndMADV9_858, Similarity Score: 82.86%

Strategy: MadV9HO, Similarity Score: 82.86%

last change: 2024-04-29 01:04:04